Tommy Mayes

Recent Posts

Approximate Reading time: Three minutes and 30 seconds

Recently I was listening to an excellent podcast (link here) in which Michael Kitces was interviewing Manisha Thakor (founder of Money Zen) about building your own media brand in an authentic way. Yes, that is a buzzword-filled subject, but I was curious. For at least the first 30 minutes or so, they talked at length about being introverts, surprising given that they make their living speaking in front of people and both have huge relationship networks. This conversation spoke to me, as I am an introvert, so I thought I would share a few observations and recommend some followup reading. Enjoy.

Topics: Advisor Practice Management

“The three greatest risk to investors: Behavior biases; loss of compounding from large portfolio losses; and the opportunity cost of being too conservative.”

- Jon Robinson, Systematic Investing And The Rise Of Emotional Intelligence -

As most know, investors notoriously underperform the market by aggressively buying at the highs and selling at the lows. In fact, a DALBAR study released this week shows the average equity fund investor experienced twice the loss of the S&P in 2018. However, it is possible to conquer this reactive fear and respond effectively to the inevitable presence of market volatility.

Topics: Behavioral Finance

As anyone who has read Blueprint insights over the last few years knows, we believe in two types of diversification. First, asset diversification is a keystone of investing and we embrace the benefits. Second, we add time diversification using trend following techniques to mitigate the vagaries and cycles of markets. Why? Because, historically, when given enough time (say 20 years), asset diversification (buy and hold) has been almost unbeatable. However, humans do not naturally invest or even think that long term and struggle with staying the course when the market inevitably course corrects either in a short-lived correction or sustained drawdown. This in turn reduces the probability of achieving their long-term financial objectives. Please allow me to elaborate.

Topics: Systematic Investing

Here we go again. All the market analysts and prognosticators have been forced by convention to rub the old crystal ball and suggest they can predict the future for the next year. They even make fun of themselves with clever art that illustrates the lunacy of the exercise – such as below. Given the fact that predictions are merely educated guesses, why does this ritual occur every year? Attention? Arrogance? Or is it a component of the human emotional bias that drives the markets overall?

Topics: Behavioral Finance

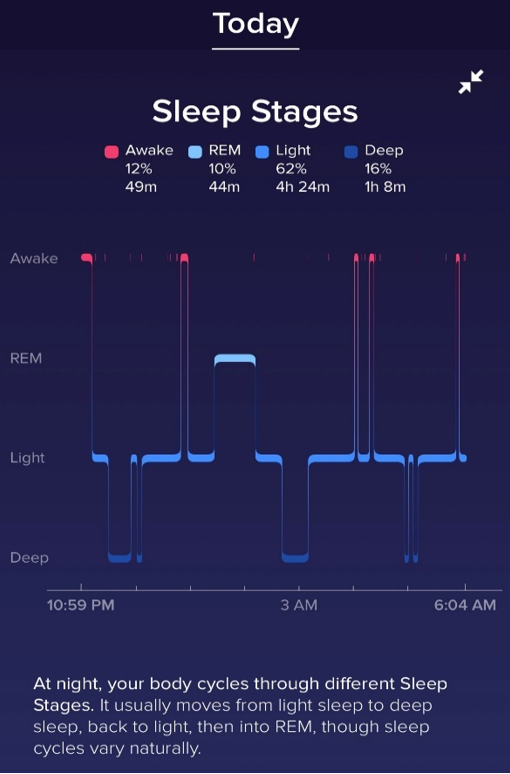

Now that I have your attention - who really thinks they get enough sleep? Many CEOs now indicate adequate rest is critical to their success! Who prioritizes rest over work or even exercise? For years, I have been obsessed by my sleep, or lack thereof. Recently my wife and I had the privilege and the pleasure of hanging out over cocktails in Laguna Beach with our new friend Dr. Michael Breus, Ph.D., known internationally as The Sleep Doctor. According to Dr. Breus, how you manage your sleep is as important as how long you sleep! This is called sleep hygiene. Read on to learn what else I discovered.