Back in 2021, as inflation rates broke out from their long-term range, we discussed a study by the Man Institute about strategies for inflationary times. Now that prices appear to be stabilizing, we can look back and ask, “How did these assets do?”

Topics: Systematic Investing

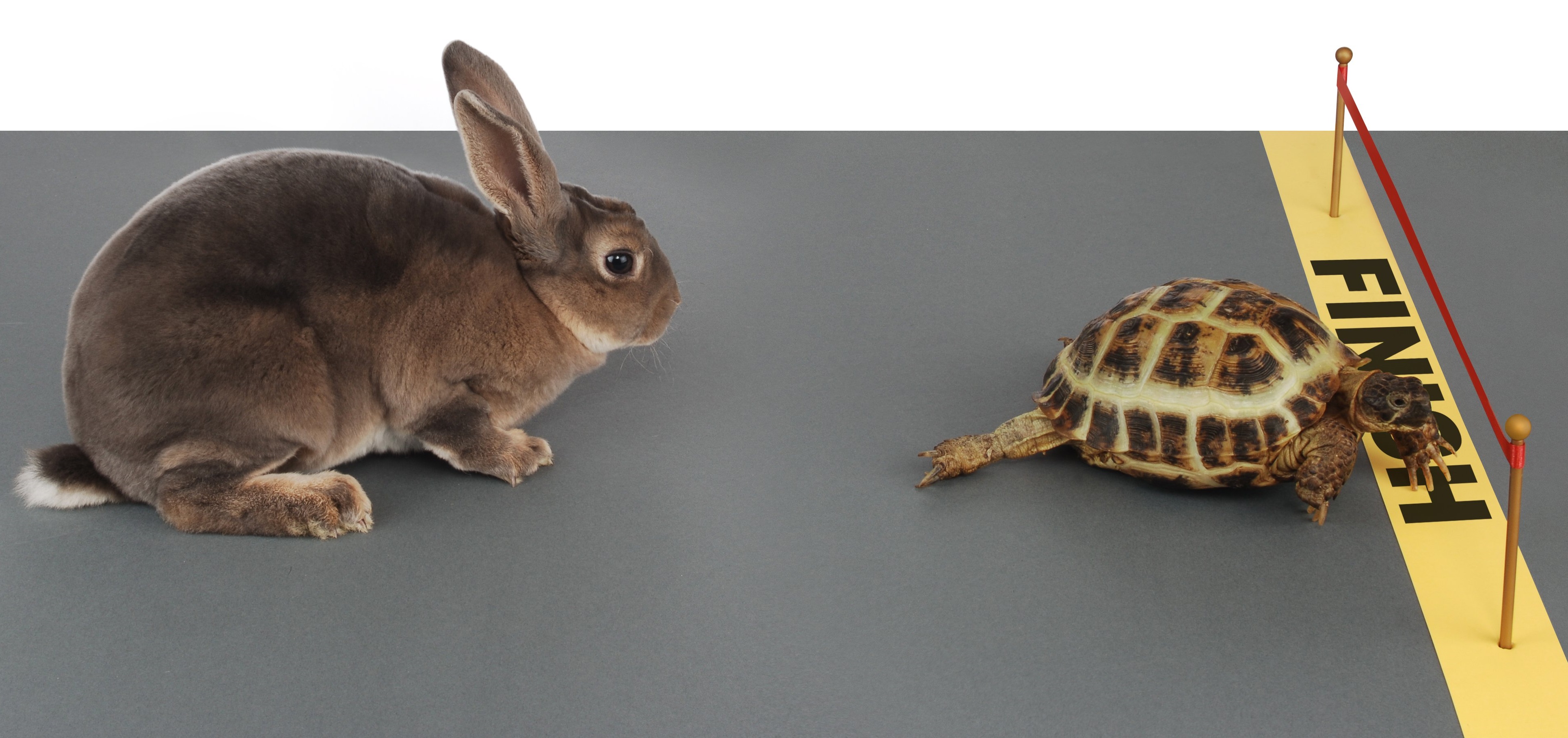

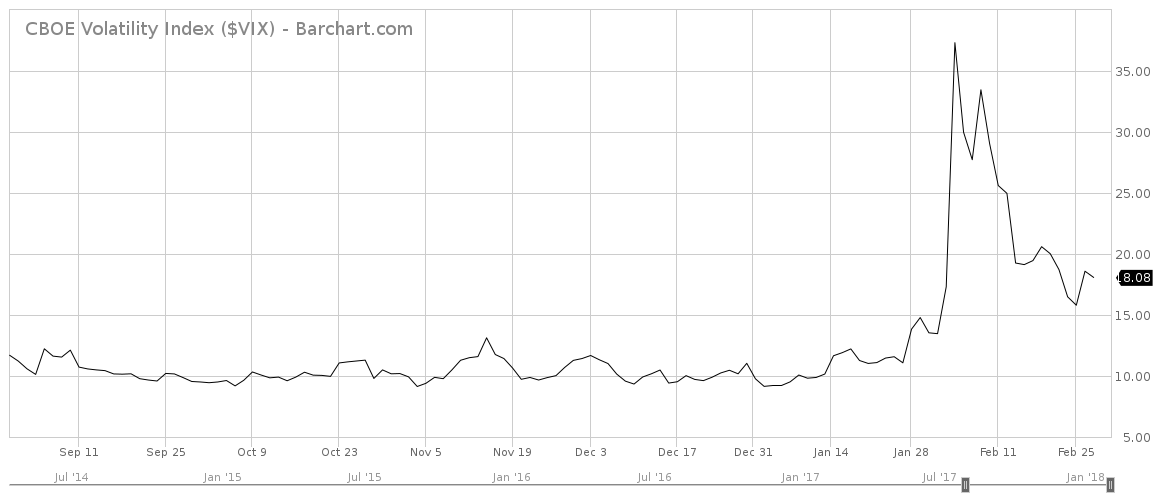

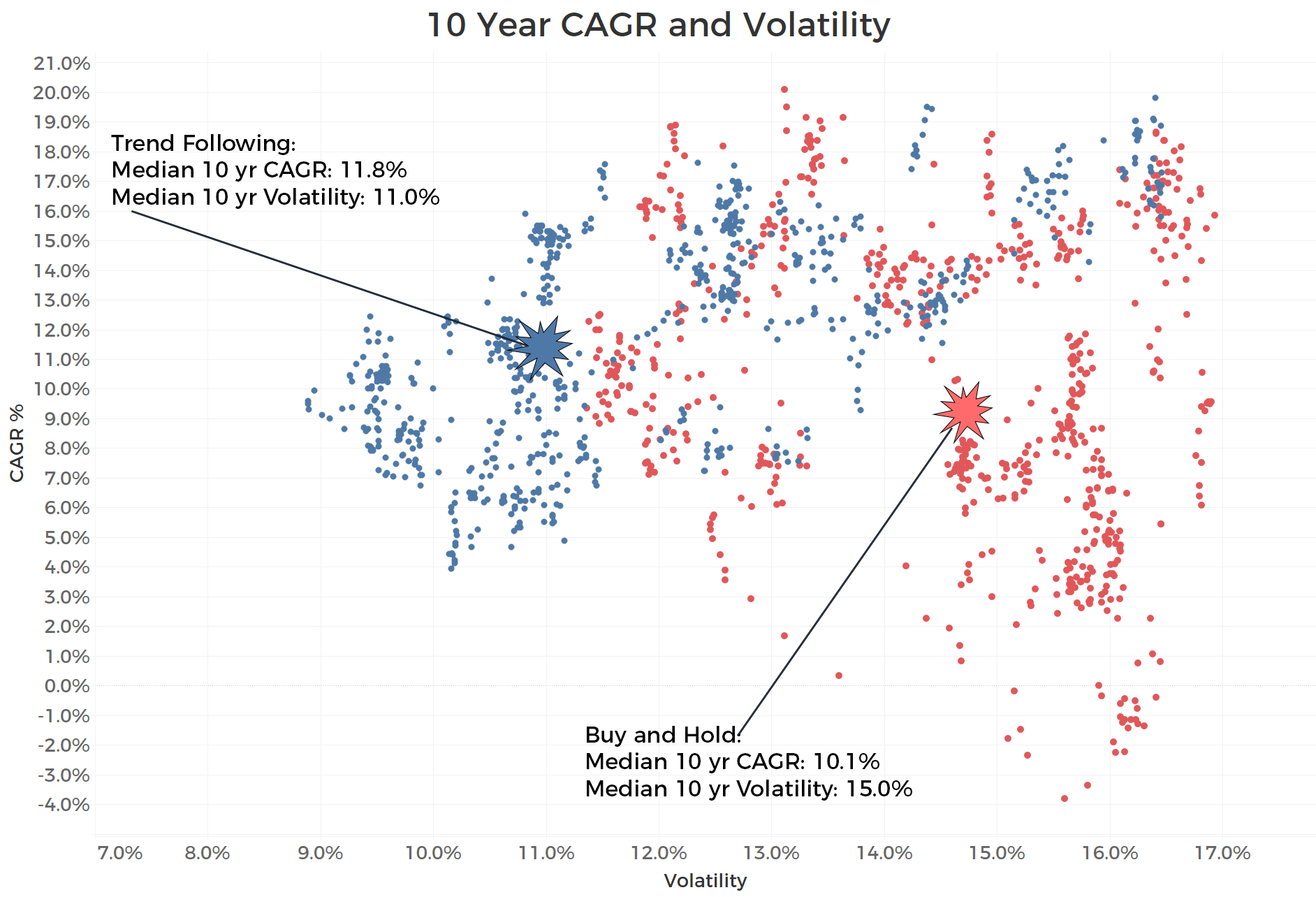

A common argument used against tactical asset management in favor of more passive approaches is that the market always comes back.

We applaud the optimism. However, we believe building an investment portfolio that assumes the market will always come back is like putting all the chips on black in a game of roulette. It’s also a terrible way for financial advisors to approach risk management in their client portfolios.

Topics: Systematic Investing

Plenty of quantitative measures support the oft-cited analogy between a financial advisor and a football quarterback. Football players view the quarterback as a leader on the field and in the locker room while investors look to their advisor for guidance and reassurance throughout the year. Quarterbacks call a play that fits the situation on the field while advisors help select investments appropriate for the client’s circumstances.

A study released last year by Morningstar Behavioral Research took this comparison a step further by offering a quantitative rationale. The report sheds light on the significance of understanding behavioral finance, as well as the pivotal role emotional factors play in nurturing the client-advisor relationship.

I want to guide you through key findings from the study and provide insights about how you may be able to utilize this knowledge in your practice.

Topics: Advisor Practice Management

Every year on the day after Thanksgiving, my family makes a two-hour drive west to the mountains of North Carolina on the hunt for the perfect tree to celebrate the holidays. It is no doubt one of my favorite family traditions.

Our tree-chopping outing just happens to coincide with the start of one of my other favorite pastimes: finding humor in the financial services industry’s annual predictions season!

At Blueprint Investment Partners, our team loves predictions. Not to make them, but to make fun of them. The idea that the average asset manager, let alone investor, can consistently predict the direction of any market or instrument reliably enough to beat a passive index over a long time period is in a word: cute.

Topics: Systematic Investing

"Nature uses only the longest threads to weave her patterns, so that each small piece of her fabric reveals the organization of the entire tapestry." –Richard Feynman

One of the most common questions we hear about our systematic investing philosophy is the comparison of trend following to value investing. We welcome these questions. As trend followers and devotees of both Charlie Munger and Ed Seykota, we see common threads in contrasting investment philosophies.

Topics: Behavioral Finance

As the head of Blueprint Investment Partners, I had a unique opportunity to moderate a virtual panel discussion with three of the biggest names in the liquid alternatives space last month: Bob Elliott, Corey Hoffstein, and Jerry Parker.

I was energized by what I saw and heard, as well as inspired to share some video clips from the discussion with you.

Topics: Transparency

Famous Strawmen: The Scarecrow & The Best 10 Days Rule

My mother has always been a big fan of Victor Fleming’s "The Wizard of Oz." When I was a kid, it would be on TV at least once a year, and mom always made a point to watch it. I usually joined her...up until the part where the witch and her creepy troop of flying monkeys showed up. From there I would typically escape somewhere to avoid them, until they returned later that night to rule in my nightmares...

The characters are all memorable due to some of the basic themes they represent, but my favorite is The Scarecrow. He values a brain over anything else and, in an ironic twist, he turns out to be the wisest of the group.

A recent running of the classic, combined with our collective enjoyment in slaying investment industry sacred cows, has me thinking about another famous strawman: the best 10 days rule.

Topics: Behavioral Finance

I recently read Howard Marks’ latest memo, “Fewer Losers or More Winners?” and it reinforced in me that this guy is a true trend follower in his own way (even if he doesn’t realize it yet). Marks is widely regarded as one of the most insightful and influential investors in the world, and his memos are read by thousands of professionals and enthusiasts alike. For those who think reading a long-form memo is like hopelessly digging in a sandbox looking for treasure, fear not, I found the treasure for you.

Topics: Systematic Investing

“Good Ideas Can’t Be Scheduled” is the title of a 2019 blog post by Morgan Housel of Collaborative Fund. His point was that deadlines shouldn’t be placed on good ideas, regardless of field, but the execution of good ideas is the opposite.

One of Blueprint Investment Partners’ best “good ideas” presented itself just like that – unscheduled – at a daunting time, during the height of pandemic-fueled market uncertainty of 2020. But we felt it would create clear advantages for financial advisors and their clients, so we got to work executing our plan.

Topics: Systematic Investing

As a kid who played whatever sport was in season, when the weather didn’t cooperate, I brought that passion inside to the latest sports video game. It was routine for me to battle my friends in games such as Madden NFL, NBA 2K, MLB The Show, and FIFA. Even the NHL made an appearance from time to time, which was peculiar for a southern kid in the 1980s.

One of the most popular aspects of these games is the ability to create a player. The create-a-player function, as it is commonly called, allows for nearly limitless customization. Your player can be tall, short, big, or small. They can be your doppelganger or look wildly different. Once created, they can be drafted and controlled like any other player, allowing the average Joe to live vicariously through their creation.

The idea of creating an ideal player got me thinking about the equivalent from an investment perspective.

Topics: Systematic Investing

“So, what do you do?”

“I’m a financial advisor.” (Not true.)

“Oh, so you pick stocks?”

“Yep!” (Also not true.)

Topics: Advisor Practice Management

Anyone who knows me will not be surprised to hear that I read “Atomic Habits”…again. In 2018, James Clear wrote this remarkable book that has reportedly been purchased every 15 minutes since publication*. Additionally, his 3-2-1 Thursday newsletter is followed by more than 2 million people. Before I finish this blog, he will have sold a couple more books!

Why is it such a great book and so widely read and referenced? Well, he has organized dozens of concepts into a compelling approach to building better habits. It is digestible and actionable.

James offers hundreds of powerful quotes and thoughts, so it is hard to imagine implementing them all. But here’s one I find particularly compelling, which is relevant for financial advisors: “You do not rise to the level of your goals. You fall to the level of your systems.”

Topics: Advisor Practice Management

As a parent, I try to encourage my daughters to be inquisitive and develop cognitive skills by answering their questions with explanations that encourage conversation. Note that I said, “try,” because I’m certainly guilty of looking at them in the rearview mirror and letting out a, “Because I said so!” from time to time.

Topics: Systematic Investing

Pretty much everyone has experienced the agony having their TV watching interrupted by the ubiquitous pharmaceutical advertisement. In fact, they have become so commonplace that an assortment of entertaining spoofs have been created, like this one.

As the video above highlights, one of the memorable aspects for many of these medications is the absurdly long list of expected and potential side effects. Now, I respect the fact that these disclosures are important in providing consumers the necessary information to make an informed decision, but that doesn’t eliminate the irony of risking death for seasonal allergy relief.

After enduring yet another round of drug ads during a recent weekend of baseball, I was struck by the similarities between prescription medication and the stock market. Both are designed to address a specific problem, from eczema to paying for long-term healthcare and education expenses. Both also have side effects.

Topics: Systematic Investing

Imagine your client losing 20% of the value of their investment, yet receiving a capital gain distribution that’s also a double-digit percentage. Impossible you say? Well, for some mutual fund investors that is exactly the scenario they face as we approach the U.S. tax filing deadline.

What lessons can we glean from 2022 and the sticker shock many investors are undoubtedly facing?

Topics: Systematic Investing

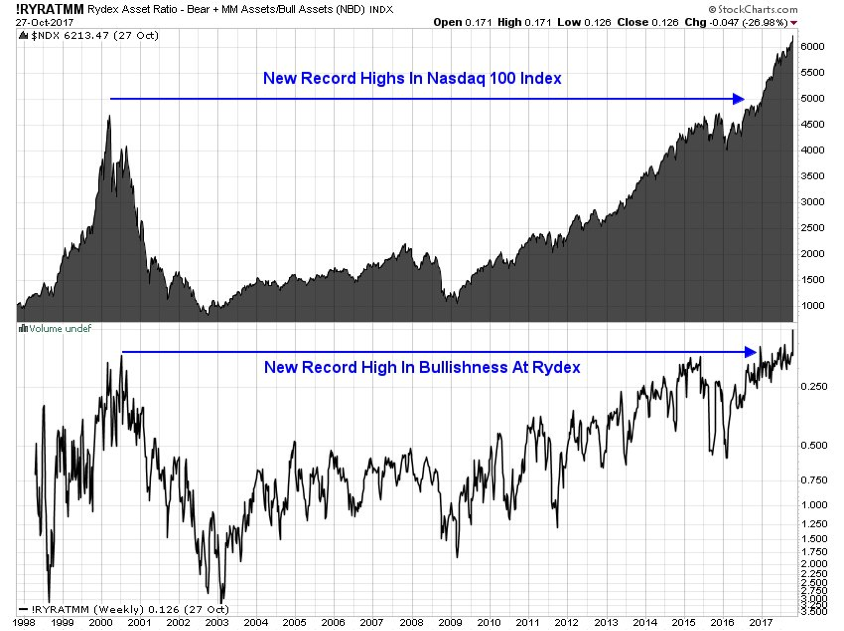

Something that unites almost every asset manager that believes it uses a disciplined, repeatable investment process is our annoyance with performance chasing. The root of this frustration is how performance becomes a shiny object that can distract some investors, and even some financial advisors. It can be particularly difficult to look away from the shine during prolonged bull markets, when human nature makes investors feel more invincible.

Here’s an ironic twist: The other day I realized that Blueprint Investment Partners, as a trend follower, actually has plenty in common with performance chasers. Except for one (gigantic) difference.

Topics: Systematic Investing

When I talk to executives and business owners as part of my work with family offices, private equity firms, and boards, I often hear comments like this: “I want to grow my business, but I do not have the time to address [you name the issue].”

The REAL issue is often that they are so busy working IN their business that they do not take the time to work ON their business. There is a tremendous difference.

Topics: Advisor Practice Management

Not 2008, not the early 1980s, but 2022 was the worst year for bonds on record, according to an analysis by investment historian Edward McQuarrie.

That’s more than a headline for financial advisors who have relied on fixed income as the less-volatile portion of their 70/30 or 60/40 portfolios – especially for their retirement-age clients. It’s a breakdown that can have lasting effects on those who can afford it the least, unless the advisor has a strategy for mitigating the risk of those impacts.

Topics: Systematic Investing

I happen to share a trainer with a local advisor. I hadn’t seen him since early 2022, so when I saw him recently, I asked him how his clients responded to the minting of a bear market in U.S. equities.

He shared that he was satisfied with the planning and preparation he had done with his clients because it yielded constructive dialogue and (mostly) content clients. However, he did join me in lamenting over the change in how many clients evaluate success during a bear market versus a bull.

We joked about how, when things are going well, the phone doesn’t ring and clients are fine with the occasional update in percentage terms. On the flip side, when markets decline, clients suddenly become very attuned and only want to know how many dollars they have lost. In short, the benchmark to which a client compares performance changes.

Topics: Behavioral Finance

Well, here we are again.

It’s that time of year when many asset managers like to make predictions about the year ahead, while Blueprint Investment Partners calls attention to the foolishness of that exercise. As evidence, I give you this January 2022 tweet from Bloomberg media personality Jonathan Ferro, who recaps how 14 leading financial firms foresaw the S&P 500 ending 2022.

Their guesses lend credence to my assertion that one of the only annual market predictions worth making is this: Following a consistent, disciplined investing process will lead to better outcomes than trusting the predictions of financial “experts.”

Topics: Systematic Investing

Why Buffett & Marks Are Trend Followers (Even If They Don’t Know It)

"When I see memos from Howard Marks in my mail,

they're the first thing I open and read." –Warren Buffett

Few (if any) money managers are better than Howard Marks of Oaktree Capital, in our opinion. I mean, can you get a bigger endorsement than Warren’s quote above? If you are not familiar with Howard's work, you can read his memos here.

In 2022, Howard perhaps unintentionally made a case for systematic investing generally, and trend following specifically, that we would be hard-pressed to match. From his July memo titled, “I Beg To Differ”:

“You can’t take the same actions as everyone else and expect to outperform.”

Topics: Systematic Investing

Systematizing the Referral Process for Financial Advisors

Remember that episode of “Seinfeld” where Uncle Leo gets Jerry’s father a last-minute appointment with a top notch back doctor? And when Jerry’s father accuses the office of stealing his wallet, Uncle Leo is mortified since he gave a personal recommendation and asked the back specialist for such a big favor.

Although this scenario was from a sitcom, it is not far off from the view of the financial advisory world held by Mike Garrison, a business coach and best-selling author. In his just-released book, “Can I Borrow Your Car?” Mike highlights the importance of knowing and trusting both parties in a referral: who you’re referring and who you’re referring to. If you “loan” a key relationship out by making an introduction, you want absolute confidence the individual will come back to you without dings, dents, or scrapes.

Topics: Advisor Practice Management

Let’s face it. If you have clients with any level of exposure to traditional assets, such as stocks or bonds, 2022 has been unpleasant. Equities closed at all-time highs in 2021, then steadily declined in 2022. Bond investors have arguably had it worse, certainly on a risk-adjusted basis.

Just when you think it can’t get much worse, unless your clients are in tax-managed strategies, another round of pain could be on the horizon. Taxes.

We hate to be the bearers of bad news, but investors – particularly those in active or semi-active mutual funds – could be in for trouble.

Topics: Systematic Investing

Can Retirement Income Be Modernized? A Guide for Financial Advisors.

Just one of these scenarios likely would be enough to cause concern for an investor:

- Potential end of the post-Global Financial Crisis secular bull market in equities

- Prospect of the first sustained rising U.S. interest rate environment in more than 40 years

- Highest inflation level in four decades

Yet in 2022, we’re facing all three at once. It’s a potentially catastrophic combination, especially for investors nearing or in the early years of retirement.

In my opinion, this is a “perfect storm” (yes, I know that’s a super cliché saying – even I cringed when typing it). And it demonstrates how the need for a more modern approach to retirement income has never been greater. It also motivated my colleague, Brandon Langley, and I to embark on a research project into different approaches to sustaining clients throughout retirement. Today, we’ve released our findings in a new white paper available to financial advisors, “An Advisor’s Guide to Protecting Retirement Income.”

Topics: Systematic Investing

When we travel by air, my wife usually points out that she thinks it would be better if people by windows boarded first; that way, anyone in an aisle or middle seat wouldn’t have to keep standing up. Meanwhile, I think the Southwest Airlines style of pick-any-open-seat is optimal.

Our “gut feelings” were recently rendered irrelevant when we ran across an old episode of “MythBusters.” In it, the cast built a mock 173-seat aircraft and tested several boarding approaches using real people and luggage.

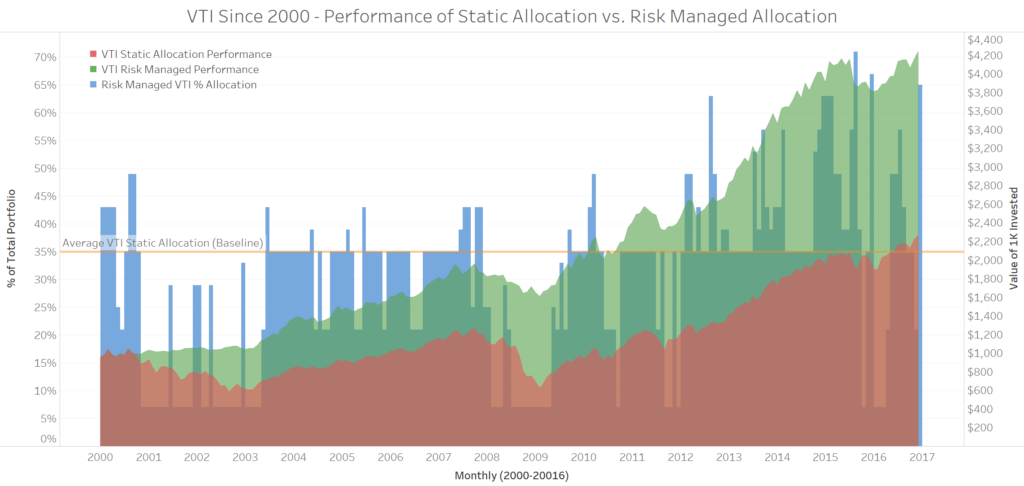

Relying on the data cut through the emotional biases. It also inspired me to take a similar data-backed look at a common question I hear about systematic investing: Is this style of investing capable of reacting fast enough to declining markets?

Topics: Systematic Investing

During market drawdowns, you often hear financial media types talking about stocks being “on sale.”

This phrase has always irked me.

I think it’s completely imprecise and utterly useless. Clichés may help sell airtime, but in my opinion they get you nowhere toward designing or implementing a comprehensive investment process.

Instead of leaning on trite phrases, wouldn’t it be a lot less stressful to have an investing process that can help both smooth out the ride and generate a more optimal client experience?

Topics: Systematic Investing

How many times have you stopped and considered the real meaning of words used every day? More importantly, how often do you challenge your own notion of that meaning by looking it up?

Recently I heard a friend and father I respect tell his son that discipline is more important than motivation. He said, “Motivation can come and go, but discipline will take you where you must go, even when you are not feeling very motivated.” It was compelling enough to me that I jotted his words down and started thinking about the meaning of those words – and also their implications.

Topics: Behavioral Finance

Courage Is Not the Absence of Fear in Mountaineering (Investing Too!)

A friend recently convinced me to watch a new(ish) Netflix documentary, “14 Peaks: Nothing is Impossible.” It follows a Nepalese mountaineer who attempts to climb all 14 of the world’s peaks higher than 8,000 meters in less than seven months.

Topics: Behavioral Finance

Don’t ask me why I know this, but there’s an episode of “Sex and the City” when the women discuss dating people who “look good on paper.” They explain that a “good on paper guy” is someone who offers great credentials, good manners, and financial stability. He seems like a great match – but only on paper, because in the real world the chemistry simply isn’t right.

Topics: Behavioral Finance

In a blog last week, I discussed how the virtually uninterrupted bull market in equities during the last 10+ years has watered down the idea of “downside protection.” This is a problem, especially since not all declines are created equal.

Topics: Systematic Investing

There are numerous examples of words and phrases entering the lexicon, providing deep meaning for many years, but over time and with frequent use losing significance among the masses. The word or phrase itself didn’t change, but the meaning was diluted by changing circumstances.

I worry that “downside protection” has run through the watering-down process.

Topics: Behavioral Finance

Vanilla is a fascinating ingredient. It is one of the most popular flavors worldwide and is incredibly common for use in baked goods. The process of creating vanilla flavoring is time-consuming and labor-intensive, which is why in its purest form it is also one of the most expensive spices in the world.

Vanilla’s widespread use and high value alone are not what makes it interesting. Take vanilla and add it to a cake mix and it enhances the flavor, turning an ordinary result into something great. But if you first bake the cake and then drizzle even the highest quality vanilla over it, you have effectively ruined the dessert.

Ingredients matter. So does the order in which they’re combined. In baking and investing.

Topics: Systematic Investing

Recently I was skimming through minutes from a weekly Blueprint Leadership Team meeting and something made me stop and chuckle. Each person had shared some good news from their week, and one had offered that she and her husband managed to shop for AND assemble several pieces of IKEA furniture without any squabbling.

It made me smile because I can relate (furniture assembly is now something I refuse to do, since it has been the biggest source of a fight I have ever seen). But it also made me realize how much I appreciate Blueprint’s tradition of sharing things for which we are grateful at the start of team meetings. It’s an opportunity to learn more about each team member, what they value, and what brings them joy.

Gratitude has a huge impact on business culture, and I thought the topic was spot on for a blog.

Topics: Advisor Practice Management

I was always terrible at those “guess how many tootsie rolls are in the jar” games as a kid. My complete lack of skill never deterred me from participating though. I mean, what kid was going to pass up the opportunity for a windfall like that?!

Topics: Behavioral Finance

Call me a luddite if you like, but few things annoy me as much as when I navigate to a new webpage and that, “How can I help you?” box pops up on the lower right. That chatbot entering uninvited always sends me on a frantic search for how to make it disappear as quickly as possible.

Those bots have fully infiltrated the online world: banks, municipal governments, dental offices, nonprofits. Even a robot for my neighborhood grocery store recently wanted to talk to me when I simply needed to verify the hours!

I think about this scenario as it relates to investors. With so much money moved into robo-advisors, what is the experience going to look like when REAL people have REAL questions? “How did the S&P close yesterday?” is easy for a robot. But what answer is going to pop up when the question is, “The market is collapsing! What should I do?” or, “How do I reduce risk in the midst of this volatility?”

More to the point of this blog: How different would the answer be if it were coming from a trusted financial advisor?

Topics: Advisor Practice Management

How does that saying go? Something about how the more things change, the more they stay the same?

Within financial advisory practices, this sentiment rings abundantly true in the area of portfolio construction/management.

So much has changed in the past few years. For one, the pandemic altered how investors interact with their advisors. Potentially more importantly, due to the prolonged bull market and relative outperformance of passive strategies, advisors have increasingly focused their attention on generating alpha from tax and financial planning.

And yet, nothing has changed at all: this same up-up-up trajectory in stocks shields many advisors from having to face the critical decision on whether to outsource the investment function of their business.

Topics: Advisor Practice Management

If you search deep in the nooks and crannies of your memory, you probably can recall one specific fashion choice you made in your younger days that you now look back on with absolute shame. You may have destroyed the pictures – I know I did, and thank goodness this was before the digital age! – but the memory is still there. Whether it be of a mullet, popped collars, parachutes pants, dramatic shoulder pads, or a rat tail, it’s in there, suppressed and collecting dust.

We made these choices because we thought it made us look cool, all our friends were doing it, or out of rebellion. We probably had friends or family members try to talk us out of it, or at least help us find a new path eventually.

Similarly, now more than ever, investors need financial advisors who can talk them out of the investing equivalent of baggy parachute pants.

Topics: Behavioral Finance

Since Blueprint is an asset manager, financial services dogma says that right now I’m supposed to tell you where the S&P will close in 2022, which asset class will be the top performer, and where Treasuries are headed.

Instead, for two good reasons I’m going to highlight some laughable predictions made by market “experts” over the years. Reason 1: We could all use a little levity right about now. Reason 2: More importantly, these predictions reinforce the truly important point that most market predictions are worthless.

Topics: Behavioral Finance

Like many others, I’m drawn to “comeback” stories. It’s no surprise, then, that the history of the world’s rarest and most ancient dog has stuck with me.

For more than 50 years, the New Guinea highland wild dog was thought to be extinct. But in the 2010s, a few reported sightings led researchers to take blood samples that confirmed the existence of a healthy, viable population hidden in a remote region.

You might be wondering how this story can possibly relate to the question posed in the title of this blog. Well, for me, it’s that the past 10+ years have led too many investors to devalue the role of a financial advisor by turning advising into an à la carte menu. Many still value financial planning, but they’re second guessing whether they need an investment quarterback. However, at Blueprint, we see signs of revival.

Topics: Advisor Practice Management

A Tax Dilemma – How Capital Gains Can Hold Financial Advisors Hostage

While a series of profitable years is wonderful, we all know the ride comes to an end at some point. When that happens, advisors seeking to manage or reduce clients’ risk level can be held hostage to the gains that have built up in taxable accounts.

As advisors add new clients/accounts and plan for 2022, now is the time to consider approaches that reduce the risk of this scenario.

Topics: Systematic Investing

Marketing for Financial Advisors – Your Questions Answered

We received a surprising amount of feedback following our September blog about advisor marketing, so we’re back with a sequel.

In these video responses (most are under 2 minutes), you’ll find answers to common questions we hear from advisors about how to refine their marketing activities to build and retain client relationships.

Topics: Advisor Practice Management

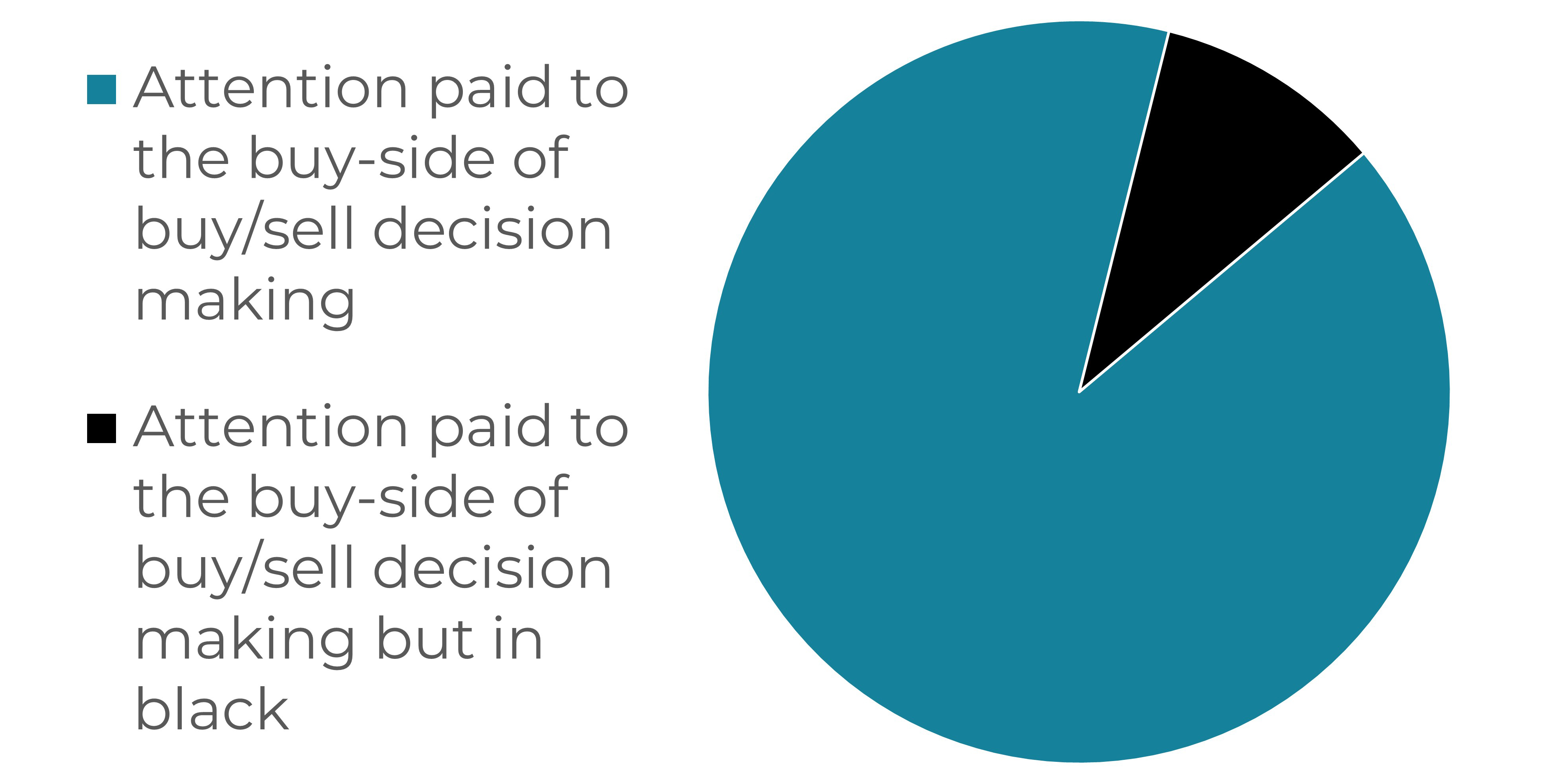

The last time an asset manager told you about their buy/sell process, did the conversation sound a lot like what’s depicted in this pie chart?

It’s bewildering, considering building and maintaining an investment portfolio requires decisions about what to buy and sell. Yet, even elite institutional portfolio managers disproportionately focus on the first half of that equation.

It turns out that’s a quantifiably costly mistake.

Topics: Behavioral Finance

We are big fans of Moneyball and share the mindset of using data to make more rational decisions. We also enjoy using lateral thinking to translate, in relatable terms, our investment process and thinking around risk management. Sports provide us with a particularly fertile environment to do that.

Of all major U.S. sports, none has a vaster treasure trove of data than baseball. Perhaps it is no coincidence then that no sport depends more on data to make tactical decisions than the national pastime.

Major League Baseball’s Fall Classic got us thinking about an interesting corollary between effective hitting and an adaptive approach to asset management.

Topics: Systematic Investing

As parents (myself included) apprehensively sent their kids back into the classroom for another pandemic-influenced school year, it put me in the mood to chip away at my own reading list, a collection of research papers that had accumulated in the “to read” folder on my desktop.

Now, before you condemn me to the nerd-set, I’m only going to cover one in this blog, and specifically one that covers a topic that’s relevant for advisors and their clients: how to best protect against inflation.

Topics: Systematic Investing

Q&A: How Can Financial Advisors Build Better Marketing Programs?

There’s a perception that all advisors offer the exact same service (or, for that matter, all asset managers, plumbers, architects, etc.). Changing perception for your practice requires building a reputation, a brand, a marketing program.

Toward that end, our firm hosted a webinar earlier this year with our friends Corey Keating and Ryan Stark, who both offer consulting and outsourced marketing services for financial advisors. It was a lively event that generated a spirted Q&A, and I think the video responses to several of the questions will be of interest to advisors who weren’t able to attend the live event (most are under 2 minutes).

Topics: Advisor Practice Management

A colleague recently shared a blog that in essence questioned why quantitative investment strategies, and specifically trend following, was not more widely embraced by the investment management industry. It was a compelling question that prompted me to consider a larger one: Is it human nature to distrust simplicity?

Topics: Behavioral Finance

I love the beach, but I am not a huge fan of the ocean.

Maybe I’m alone here, but after watching “Jaws,” National Geographic programming, Shark Week on Discovery, and “Sharknado” 1-6, I just cannot shake that uneasy feeling when I’m venturing into the surf. Even when I’ve had the privilege of swimming or snorkeling in those crystal-clear Caribbean waters, there’s still a bit of anxiety of what’s potentially lurking in the distance just out of sight.

As we talk to advisors, it’s clear my feelings about getting into the ocean are similar to how they feel as they put client money to work during this seemingly endless bull market.

We routinely encounter advisors who are struggling with how to invest in equities right now. This is particularly tricky for those that have taken a more cautious approach during the last couple of years and now have to face tough performance-related questions and risk losing clients.

Topics: Systematic Investing

What are your re-watchable movies? For me, it’s several cult classics from the mid-90s. It doesn’t matter how many times I’ve seen them, if I happen to catch them when flipping through the channels, I’m going to stop. Unfortunately, I usually end up only watching briefly until my wife rolls her eyes and asks, “Again…really?”

Recently, during my 845th viewing of “Tommy Boy,” I noticed an interesting parallel between Tommy’s description of the guarantee when selling brake pads and the act of wholesaling downside protection to advisors. Indeed, the guarantee does make you feel all warm and toasty inside, but is it really a “guarantee fairy” who’s a crazy glue sniffer?

Topics: Systematic Investing

The Line Between Chasing Winners & Catching a Falling Knife

A few weeks ago my family spent a week at the beach. There’s this arcade on the boardwalk. I’m sure you know the kind: Drop a $20 in the change machine, hope your 8 year old can keep the Skee-Ball in her own lane, and then trade your tickets for some plastic toy that inevitably will provoke several sibling squabbles until it snaps in half a few days later.

Good ol’ American family fun!

As we dropped quarters in the machines, I noticed something interesting about my daughter’s approach to choosing which game to play that I thought had parallels to investing. She raced from game to game, chasing the ones she thought would give her the most tickets per play. When we made it to the prize counter, surprisingly, she ended with fewer total tickets than my son, who mainly just knocked over clowns with an air gun.

Topics: Systematic Investing

In a time when seemingly all assets are “melting up,” allow me to invoke one of my favorite Saturday Night Live characters, Debbie Downer, and provide a less-than-rosy dose of reality: U.S. government bonds, which have a “market cap” that’s equivalent to 2x the U.S. stock market, have all entered a bear market.

If you know the Debbie Downer persona, you probably read that statement with her voice in your head – and you’ll definitely be able to “hear” the sound of these words: WAH! WAHHH!

Topics: Systematic Investing

The 2021 NFL Draft, which begins tomorrow, is expected to highlight more than ever that quarterback is arguably the most important position in all of sports.

If we stick to football and assume QB is indeed the most important role, what is second? Many cases can be made, but if money talks, then shouldn’t the answer be found in how NFL teams invest their hard-capped dollars?

And if so, what lessons can advisors take from this to improve their practices?

Topics: Advisor Practice Management

Doesn’t it seem like Wall Street can monetize a movement like nobody else? Perhaps that’s what makes it so interesting when one of The Street’s own blows the whistle to question authenticity.

Topics: Transparency

This is not another article about Reddit, Robos, and Robinhood.

Well actually, it a little bit is. But hear me out: We’ll be light on the pontification (you don’t need a 4,000th article on GameStop) but heavy on the conundrum financial advisors face and the trump card held by providers of financial advice.

Topics: Advisor Practice Management

Perhaps you’ve heard this saying: “There are old pilots; and there are bold pilots; but there are no old, bold pilots.”

The same applies to investing because at the end of the day – for both pilots and investors – it’s about their respect and tolerance for risk.

Said another way, the key to longevity is survival.

Topics: Behavioral Finance, Systematic Investing

Perhaps the most striking characteristic of economic bubbles – which is also what fuels their very existence – is our blindness to them.

Historically, few have correctly called a bubble in advance. And yet, in modern times, people have been asking if we’re in the bubble since 2010. What gives?

Topics: Behavioral Finance, Systematic Investing

My colleague, Brandon Langley, and I began writing about the pitfalls of a traditional 60/40 portfolio back before it was trendy. He and I felt so strongly about the topic that we published a white paper in August of 2018. Some considered us renegades back then for having the audacity to question what had been the bread-and-butter strategy that helped millions of investors retire comfortably.

But the question is: Will the 60/40 allow the next generation of investors to also retire well?

Topics: Systematic Investing

A colleague recently shared with me a story about a January tradition of the Kiwanis Club of Cape Fear in Fayetteville, NC, which holds a contest to see who can best predict where the Dow Jones Industrial Average will end the year.

She described how some members have a thoughtful internal debate while others jot down numbers seemingly at random. By the following year, pretty much no one remembers the guess they submitted, and rarely is the winner someone within financial services. A chiropractor won in 2020, a national defense analyst the year before.

What made the contest sound so fun to me is that the guesses and winners seem so haphazard and unexpected. Why? Because most predictions are garbage.

Topics: Behavioral Finance

At Blueprint, we like to think that our trend-following proclivities have many applications. Some (like our ability to systematically manage assets for our advisor clients) are certainly more useful than others (like the fresh 2020 pop culture reference that will come when you read on).

Topics: Advisor Practice Management, Behavioral Finance, Systematic Investing

In my view, there is a common misconception that most financial advisors are also entrepreneurs. I do not see the advisory business as being statistically different from any other industry in terms of the mix between business owners/operators and entrepreneurs.

Topics: Advisor Practice Management

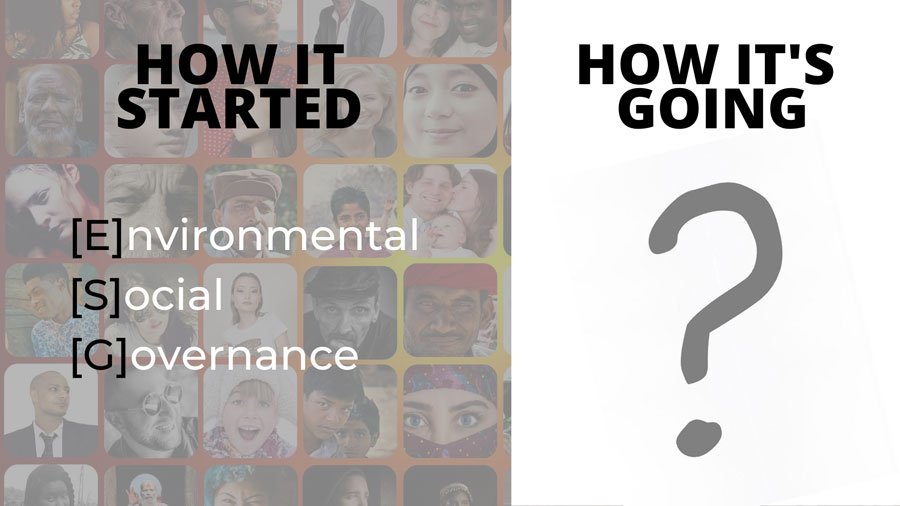

You may have seen or heard about the, “how it started...how it’s going,” trend that’s been going around the internet lately.

The concept is to show the passage of time in two images, often to highlight accomplishments and sometimes purely for comedic value — you’ll find examples of each in this post.

In this blog, which is the last of a three-part series on ESG investing, we’re looking at the, “how it's going,” particularly as it relates to adoption and implementation.

Topics: Systematic Investing

It took some painful contortions in the markets this year for many advisors to realize robo-advisors may not be as diversified and risk-managed as they claim.

At Blueprint, we believe there is a “sweet spot” between the rudimentary machinations of a robo-advisor and a more traditional asset allocation method. In fact, we’ve bet our business on it. But, this briefing isn’t meant to say, “I told you so,” rather to articulate a solution to a problem that many well-intentioned advisors are contemplating.

Topics: Behavioral Finance, Systematic Investing

ESG Investing: Driven by Risk Management & Client Demand (Part 2)

There’s been a paradigm shift in our recent conversations with advisors about ESG investing.

Whereas ESG investors previously were thought by some to be anti-capitalist tree huggers, this silly trope has run its course. Instead, there is a realization that optimal management of resources, social equity, and ethical corporate administration can significantly benefit human productivity and profits across the board.

This realization has helped portfolio managers recalibrate the idea of risk that is embedded within a portfolio. Just the same, the groundswell that is ESG has made it increasingly self-evident to investors that they no longer have to choose between their ideals and returns.

Topics: Systematic Investing

You Can’t Win a Tournament in Round 1, But You Sure Can Lose It

Haters who know I bleed “Carolina Blue” will accuse me of taking a cheap shot with the story I’m about to retell. But when the world of sports rivalries intersects with managing risk in an investment portfolio, it seems unreasonable to ask me to not make the following comparison!

Topics: Systematic Investing

A confession: Without CliffsNotes, I may not have made it through high school…or college. In fact, until just recently, I actually thought it was “CliffNotes” (no “s”) – but I digress.

If you’re like me, these very valuable summaries are extremely helpful and efficient. With that in mind, I wanted to share three takeaways from a financial services virtual event last week, all of which struck me as highly relevant for elite financial advisors.

Topics: Advisor Practice Management

ESG Investing: On Par with Value, Growth, or Momentum? (Part 1)

“[B]ecause capital markets pull future risk forward, we will see changes in capital allocation more quickly than we see changes to the climate itself.”

And just like that, Larry Fink, CEO of BlackRock, potentially changed everything. This quote is taken from his letter to CEOs in January, where Fink argues that climate change is the defining determinant of a company’s future success.

We believe his letter foreshadows a world where environmental, social, and governance factors are on a similar playing field as value, quality, and momentum.

Topics: Systematic Investing

My husband recently nearly talked me into purchasing his definition of “a decent” wristwatch — and it was a reminder of how we, as humans, are completely irrational.

Topics: Systematic Investing

No Fluff. No Black Box. Just Real-World Next Steps for Financial Advisors

You know those days, when you’re practically on autopilot as you delete, delete, delete your way through our inbox?

Until it happens. A headline just grabs you. The sender is addressing a pain point you’ve been experiencing and, better yet, they’re offering practical guidance. Amazing!

You click through to their website, somewhat-begrudgingly fill out the 10 fields of info they want from you, find the PDF in your downloads folder, click to open the file — and then the disappointment hits...

Topics: Advisor Practice Management

How to Become an Elite Financial Advisor: Practice (Business!) Management

Have you read something like the following roughly 1,237 times in the last few months?

“Financial advisors are under immense pressure, particularly with the paradigm shift of 2020. They must provide value to their clients and differentiate themselves from other advisors.”

We too see plenty of pontification out there. Well-intentioned writers, podcasters, and vloggers are doing a great job of capturing WHAT challenges advisors face. But, they usually stop short of offering answers to, “HOW?”

In this blog, we’re filling the void and providing a map.

Topics: Advisor Practice Management

Are you an elite advisor? A new quiz helps you compare your practice to a standard in operational performance. The result? A better understanding of your areas of strength and opportunity in just a few minutes.

Topics: Advisor Practice Management

Honestly, there’s not much of a curtain either.

Sparked by our recent whitepaper, The Elite Advisor Playbook, we’ve been having conversations with advisors about how to adapt to the new environment (and I don’t just mean the one created by the coronavirus). These discussions usually lead to agreement that advisors struggle to modernize their practices.

However, two questions the playbook does not answer are, “Why is this framework an optimal picture of an elite advisor, and how can it be implemented?”

Today, we’re tackling the first.

Topics: Advisor Practice Management, Transparency

Podcast: Like a Fitness Trainer Who Can Do the Exercise for You

Let’s say you want to drop a few pounds or improve your physical strength. You might hire a trainer to help create a plan and provide guidance.

Now imagine your trainer wasn’t just there for encouragement, but could actually do the exercise for you? That’d be a gamer changer!

That’s how an outsourced systematic investment manager helps financial advisors eliminate behavioral bias and stick to the process: by doing “the exercise” for them.

Topics: Behavioral Finance, Systematic Investing

Death of a Wholesaler: The Future of Asset Management Marketing

I'll start off by saying that prior to joining Blueprint, I was nicknamed "MC Spammer."

Yeah, that's right.

It was funny…at first.

In fact, I joined Blueprint because I knew there had to be a different way of engaging and partnering with advisors: no scripts, no "hard close," just creating value, and permitting interested advisors to reach out to us. But, for this approach to work, buy-in and patience is required – everyone on the team must be onboard.

Topics: Advisor Practice Management

While advisor practice management has long been a part of our content cadence, the response to our recently published whitepaper, The Elite Advisor Playbook, has left no question as to how we can continue to help advisors seeking to deliver excellence both in asset and practice management. We knew there was an appetite for these ideas but must concede we underestimated the extent to which financial advisors are yearning for practical solutions.

Topics: Advisor Practice Management

Blueprint’s core client is the independent financial advisor. They tend to be planning-focused, tech-savvy, and very entrepreneurial, as many either started as an independent or broke away from a wirehouse. Over the years, we have developed institutional knowledge about the behaviors, tactics, and strategies employed by the most effective advisors – advisors worthy of being called "ELITE."

Topics: Advisor Practice Management, Systematic Investing

We are excited to share with our readers and friends a fantastic interview with Jon Robinson by Financial Advisor magazine featured columnist, Bill Hortz. In it, Jon and Bill discuss managing risk in a post-pandemic world, key questions advisors should be asking of their asset managers, and what represents prudent investing today. Blueprint's philosophy and story are also explored, providing valuable insight into how and why we do what we do. We are immensely grateful for the opportunity to have this discussion with Bill and hope that you enjoy reading it.

Topics: Systematic Investing

Clients and partners of Blueprint know how much we value communication and transparency. We are not shy about being transparent (some would say to a fault), from putting our exact investment rules on our website to explaining in detail how these rules work. One thing that we (and the world) are learning in 2020 is that despite how we miss interacting with our clients, friends, and partners in person, we can still add value and communicate effectively through a variety of other, tech-driven mediums. Case in point: as of December 2019, the number of free and paid Zoom meeting participants was 10 million; today, it's 300 million!

Topics: Transparency, Systematic Investing

Approximate reading time: less than 3 minutes

When something happens that has never happened before, do we assert it was unpredictable? On Monday the front month contract for WTI crude oil went negative in price and traded there, as holders were attempting to get rid of the obligation to take delivery. How much can I pay you to take my oil? Amazing. Times like this challenge everything we think we know about the financial world and beg the question, ‘can anyone really predict the future value of any asset?’ What is the truth? I think the answer is up to the reader, but we believe that no one really can.

Topics: Transparency, Systematic Investing

What does history explain about the future? Part 1

The last 20 years have given us three major market shocks. These resulted from the end of a tech bubble, a financial crisis and now, a global pandemic. During this time, investors have experienced every emotional high and low that can be imagined, yet in general, the approach to investing delivered by the financial services industry has not fundamentally changed. Today’s note establishes the case for why this has to change. Read on…

Topics: Behavioral Finance, Systematic Investing

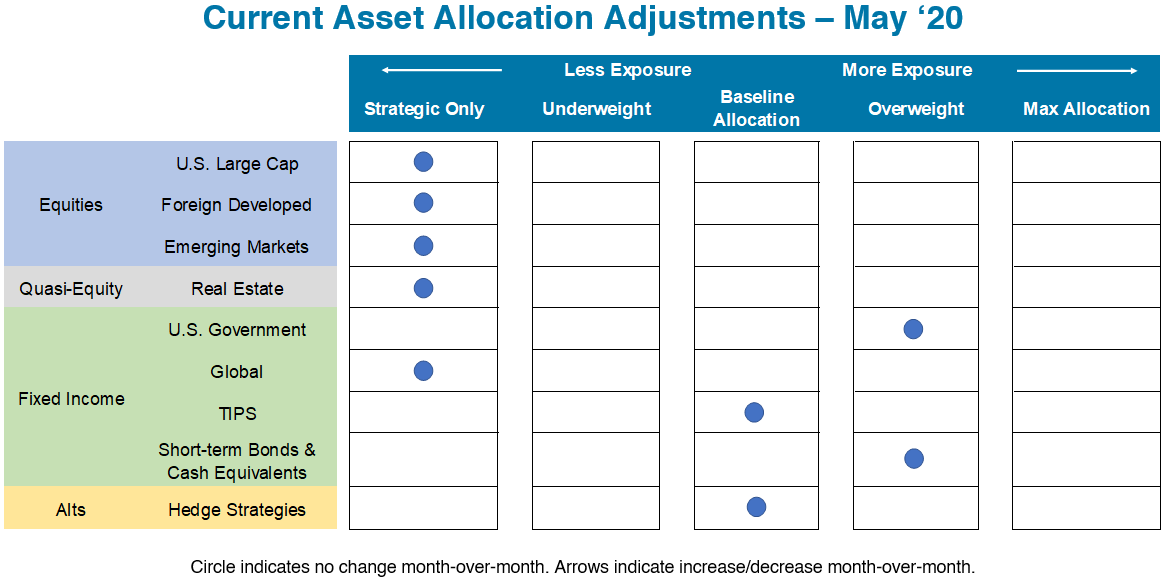

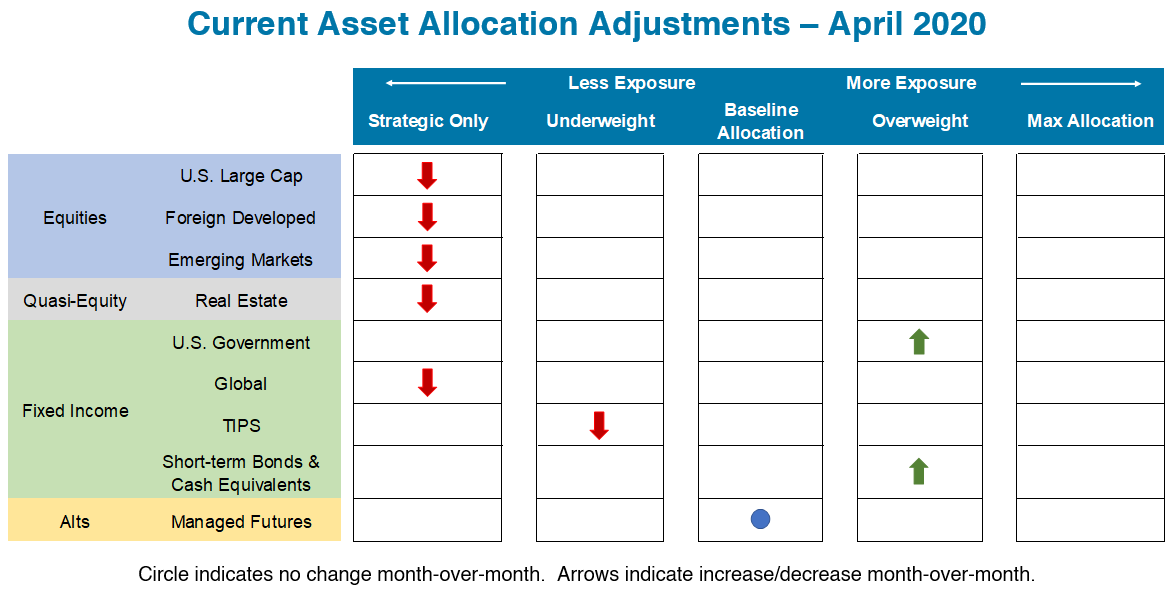

First, we sincerely hope this note finds everyone safe and healthy in your world. Blessings abound for our team and our families, and we are grateful to be here to serve our clients and friends. To paraphrase the line from Cool Hand Luke, we will not be accused of a ‘failure to communicate’! Every month, on the last trading day when we rebalance our portfolios, we send a note to our clients and partners with an update on changes in the model and the status of price trends based upon our rules and systems. This month, we want to share it with our full audience, because we believe it is insightful regarding the current environment, and because we are proud of our work. Please read on.

Topics: Behavioral Finance, Transparency, Systematic Investing

What incredible times we are living through right now. About six weeks ago here in the United States all seemed quiet and strong. Of course, there are always problems, but by comparison to today, things were positive. Boy, that seems like a long time ago.

Regardless of how this coronavirus pandemic plays out, the lesson we can already take from this is that…you just never know. No matter how good things seem and no matter how long the fun ride has lasted, it always comes to an end, and usually when we least expect it. The movie Cocktail, starring Tom Cruise, brings us Flanagan’s Law, “All things end badly or else they wouldn’t end.”

Topics: Advisor Practice Management, Systematic Investing

By most measures, markets have entered a bear phase and are down almost 20% from all-time highs. The coronavirus, oil rout, and politics have combined to create a perfect storm in the markets. In times like these, what do we crave most? Surely, we all want to be safe and to know that the virus spread has slowed and that a cure or vaccine is ready to be deployed in abundance. We want to have control when none is available. Short of control, the next best thing we hope for under a constant barrage of bad news is…clarity.

Topics: Advisor Practice Management, Behavioral Finance, Systematic Investing

When I first joined the team here at Blueprint, there were several "Ah ha" moments that stood out. Coming in, I considered my role as National Sales Director to be leading the effort to broadcast the power of Blueprint’s sophisticated, yet simple story. As I reviewed our existing marketing materials, I noticed a chart comparing our Growth strategy (an 80/20 stock/bond model at its baseline) to a traditionally allocated Balanced portfolio.

Topics: Advisor Practice Management, Behavioral Finance, Transparency

Let’s begin with a bold statement: no financial advisor (or asset manager for that matter) has ever been fired for over-communicating with their client. But according to a recent study, a lack of communication is perhaps the easiest way to get replaced. Even the best advisors sometimes forget this. A survey of individual investors reveals that 64% of clients with assets greater than $500K report being contacted “infrequently” or “very infrequently” by their advisor. As we enter the eleventh year of the longest and best performing bull market in U.S. history, there has never been a better time for a proactive review of your client communication strategy.

Topics: Advisor Practice Management

Forecast: Unpredictability with a Chance of Irrational Behavior

Word Count - 679 Words

Reading Time - ~3.5 minutes

Last week, Blueprint hosted a webinar with our friend Jay Mooreland, author of The Emotional Investor. The event motivated me to reread his book, which I highly recommend. It also reminded me of the investment industry’s annual prediction cycle about what to expect for the coming year and how the market will behave based upon those predictions. Two points here: one, analysts and economists have no idea what is going to happen and two, what happens does not matter to the disciplined investor. Read on!

Topics: Behavioral Finance

Word Count - 703

Approximate Reading Time - 3.5 minutes

So much has been written about the consumption of TD Ameritrade by Schwab that we hesitated to say anything on the subject. However, our experience with elite advisors, investment platforms (TAMPS), and larger RIA consolidation firms leads us to the conclusion that this transaction is just the tipping point in the changing world of custody, and that now is the time for advisors to take a strategic look at all their options.

Topics: Advisor Practice Management, Behavioral Finance, Systematic Investing

Are Only 7% of Financial Advisors Equipped for Portfolio Management?

A study published in October by Cerulli Associates, a Boston-based financial services research and consulting firm, found that only 7% of financial advisory practices were suited to do their own research and portfolio construction/management. Yet, according to the same study, 62% of advisors are in fact performing these functions on behalf of their clients. Of course, there are nuances that Cerulli doesn’t fully dive into. But, we think the underlying question is relevant: just because you can manage assets, does it mean you should?

Topics: Advisor Practice Management

My partner and I started Blueprint years ago, propelled both by a renegade streak and the desire to help improve people’s lives. We wanted to create a business of our own and something better than was available in the marketplace. If successful, we also believed it would afford us the ability to have families and provide for them. Perhaps it’s something that only the founder of a business will truly understand.

Excitement, fear, joy, anxiety, and back again, all before your morning coffee.

Topics: Advisor Practice Management

“Nowadays people know the price of everything and the value of nothing.”

Lord Henry Wotton, A Portrait of Dorian Gray by Oscar Wilde

While Wilde’s masterpiece was published in 1890, there’s much about it that feels prescient today. This quote in particular calls into question the futility of yearning for the possession of material things. Sticking with the theme of 19th-century paragons, it was in 1899 that economist Thorstein Veblen coined the term “conspicuous consumption” in his most famous work, The Theory of the Leisure Class. Veblen’s concept can be illustrated by the desire to drive a luxury car rather than an economy car. Though both serve the exact same function, the former calls to attention the apparent affluence of the driver. Both Wilde and Veblen would likely agree that the price of this good exceeds its actual value.

Topics: Advisor Practice Management, Behavioral Finance

The Impact on Advisors (Does Free = Free?)

A frequent topic in our writing is the changing landscape for advisors and investors in terms of the cost of doing business and the impact of technology. With so much rapid change taking place in the industry, there has not been a shortage of material. In fact, it was only a few years ago that things like trading commissions were a major consideration when developing investment strategies. What are now mainstream approaches, like passive investing, robo-advising, and low to no commissions, were once either obscure or did not exist. We are now simultaneously experiencing peak passive and a new low in the race to the bottom on fees.

Topics: Transparency, Systematic Investing

Investor Behavior Matters: One Trillion Votes and Counting

Earlier this month, Jason Zweig wrote an insightful article about Target Date Funds (TDF), which in the last year surpassed the one trillion-dollar mark in assets under management. In the piece, he provided some background on these instruments and how they have been perceived in the market. He concluded by describing the current equity exposure across some of the prominent TDF providers.

Topics: Behavioral Finance

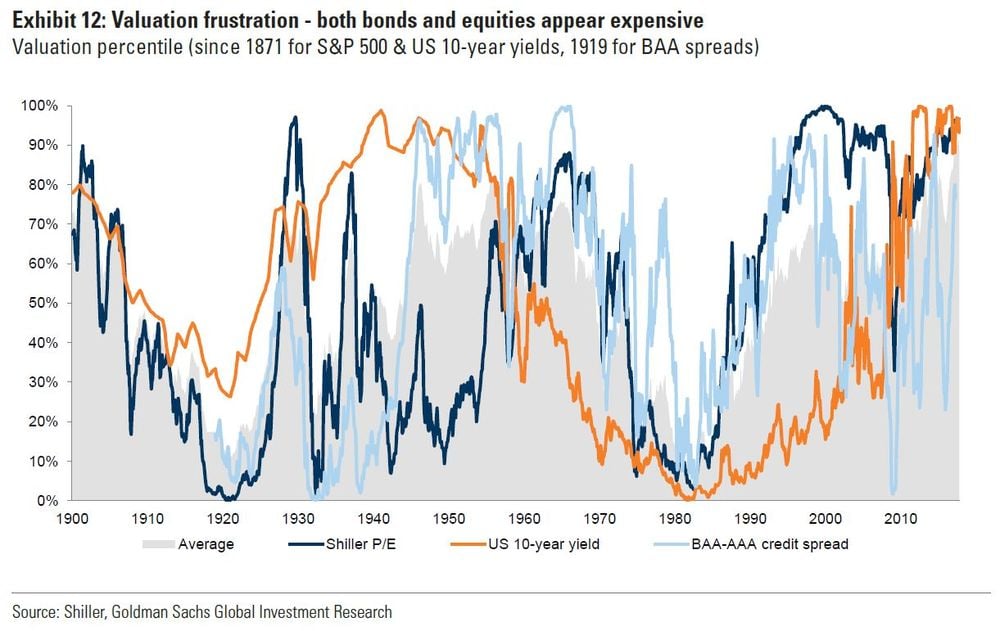

If you are paying any attention to the media the last few weeks you know at least two things: China and the United States are having a tariff standoff, and the market (AKA all things tradeable) is having a rough end to the summer. On the latter point, why does volatility to the downside drive so much hysteria and so many prime time CNBC specials? I believe it is simply because we are all human.

Topics: Behavioral Finance, Systematic Investing

If you are like me, you probably spend a lot of time marveling at and studying the likes of Amazon, Google, and even Facebook. Each is only about 20 years old, yet they each occupy a spot in the world’s ten most valuable companies. Casting aside the varying forms of backlash they have experienced recently, there is much to admire about each firm’s growth and ubiquity.

Topics: Advisor Practice Management

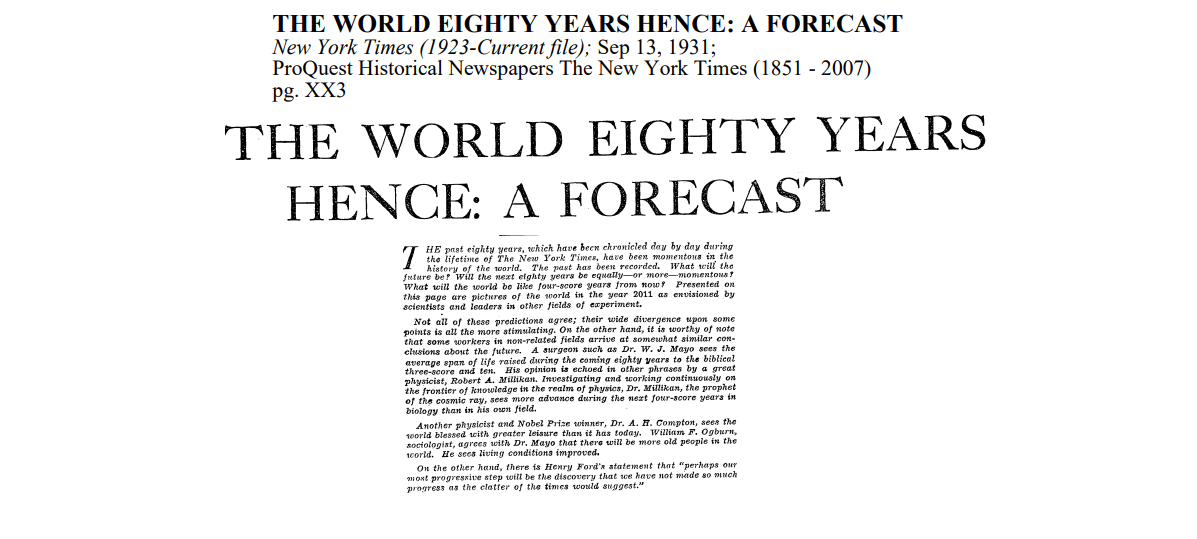

In 1931, the New York Times, celebrating its 80th birthday invited eight American innovators to predict what life would be like in 80 years. Among them, Dr. William Ogburn, a sociologist, predicted that "people will become more nervous and mental disorders will rise for a time, but by 2011 mental hygienists will probably have the upper hand.” W.J. Mayo, the founder of the Mayo Clinic, said that by 2011, the average life span, then only 54, would rise to 70 (it was 78). As we have written before, market predictions are generally useless even when correct. Why is there such a fascination with predictions to begin with?

Topics: Behavioral Finance, Systematic Investing

Approximate Reading time: Three minutes and 30 seconds

Recently I was listening to an excellent podcast (link here) in which Michael Kitces was interviewing Manisha Thakor (founder of Money Zen) about building your own media brand in an authentic way. Yes, that is a buzzword-filled subject, but I was curious. For at least the first 30 minutes or so, they talked at length about being introverts, surprising given that they make their living speaking in front of people and both have huge relationship networks. This conversation spoke to me, as I am an introvert, so I thought I would share a few observations and recommend some followup reading. Enjoy.

Topics: Advisor Practice Management

Blueprint believes a major preoccupation for investment advisors and financial planners has become their clients’ emotional quotient (EQ), as it surpasses the intelligence quotient (IQ) in the advisor value chain.

Advisors studying the Blueprint approach to systematic investing often ask the question of how Blueprint’s investment methodology differs from Smart Beta strategies that similarly rely on quantitative modeling.

Before answering this question, allow us to provide some context.

Topics: Behavioral Finance, Systematic Investing

“The three greatest risk to investors: Behavior biases; loss of compounding from large portfolio losses; and the opportunity cost of being too conservative.”

- Jon Robinson, Systematic Investing And The Rise Of Emotional Intelligence -

As most know, investors notoriously underperform the market by aggressively buying at the highs and selling at the lows. In fact, a DALBAR study released this week shows the average equity fund investor experienced twice the loss of the S&P in 2018. However, it is possible to conquer this reactive fear and respond effectively to the inevitable presence of market volatility.

Topics: Behavioral Finance

The race to zero in the ETF world has its first winner. On February 25th, online personal financial services company Social Finance, Inc. (SoFi) announced the industry's first zero-fee ETFs. The filing consists of four ETFs in total, with two of the funds (SFY, SFYX) having fee waivers in place until at least March 27, 2020, effectively bringing their total fund expenses to zero for the first year of operation. But much like a buy one get one free offer, it is not immediately evident that a zero fee ETF is always a good value. We believe there is more to the story, and make the case below.

Topics: Behavioral Finance, Systematic Investing

As anyone who has read Blueprint insights over the last few years knows, we believe in two types of diversification. First, asset diversification is a keystone of investing and we embrace the benefits. Second, we add time diversification using trend following techniques to mitigate the vagaries and cycles of markets. Why? Because, historically, when given enough time (say 20 years), asset diversification (buy and hold) has been almost unbeatable. However, humans do not naturally invest or even think that long term and struggle with staying the course when the market inevitably course corrects either in a short-lived correction or sustained drawdown. This in turn reduces the probability of achieving their long-term financial objectives. Please allow me to elaborate.

Topics: Systematic Investing

Execution is everything

Do your job. This simple three-word phrase has served as the mantra for the New England Patriots and their long-time coach Bill Belichick during their incredible run since 2000. Being from North Carolina, I’m proudly a Panthers fan, but I have always respected and appreciated the ‘Patriot way.’ Six Super Bowl wins in nine appearances is a spectacular achievement, particularly in a sport theoretically geared to ensure parity and discourage dynasties.

Topics: Advisor Practice Management

Here we go again. All the market analysts and prognosticators have been forced by convention to rub the old crystal ball and suggest they can predict the future for the next year. They even make fun of themselves with clever art that illustrates the lunacy of the exercise – such as below. Given the fact that predictions are merely educated guesses, why does this ritual occur every year? Attention? Arrogance? Or is it a component of the human emotional bias that drives the markets overall?

Topics: Behavioral Finance

The active vs. passive debate reached a fever pitch on Monday when Jeff Gundlach referred to passive investing as a ‘mania.’ As expected, Vanguard quickly defended passive index funds by saying that “the data simply does not support his claims.” There is certainly nothing new about this debate. It’s been escalating since the first index funds were launched in the mid-70’s. However, moments like this remind the Blueprint team why we utilize passive index funds in the first place –they are the tools we use to build portfolios on behalf of our clients.

Topics: Behavioral Finance, Systematic Investing

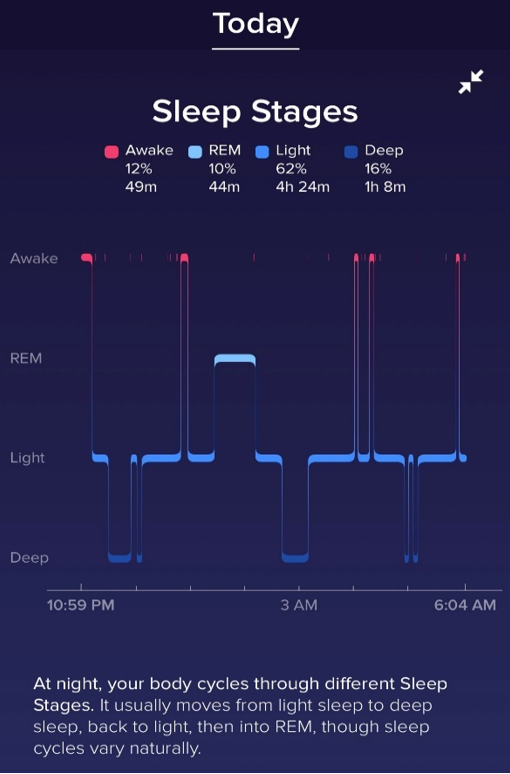

Now that I have your attention - who really thinks they get enough sleep? Many CEOs now indicate adequate rest is critical to their success! Who prioritizes rest over work or even exercise? For years, I have been obsessed by my sleep, or lack thereof. Recently my wife and I had the privilege and the pleasure of hanging out over cocktails in Laguna Beach with our new friend Dr. Michael Breus, Ph.D., known internationally as The Sleep Doctor. According to Dr. Breus, how you manage your sleep is as important as how long you sleep! This is called sleep hygiene. Read on to learn what else I discovered.

Topics: Advisor Practice Management, Behavioral Finance

Forbes Interview: Systematic investing & the rise of emotional intelligence

We at Blueprint are excited to share with our readers and friends a fantastic interview with Jon Robinson and Tommy Mayes by Forbes contributor Peter Hans. In it, Jon, Tommy, and Peter discuss systematic investing, emotional intelligence, liquid alternatives, and more. Blueprint's story and background is also explored, providing valuable insight into how and why we do what we do. We are immensely grateful for the opportunity to have this discussion with Peter, and hope that you enjoy reading it as much as we enjoyed telling it.

Topics: Behavioral Finance, Systematic Investing

At Blueprint, we utilize tactics based on the fundamentals of Trend Following, attempting to smooth the investment ride and to keep compounding high for our advisor clients. We generally do this using passive instruments such as index-based ETFs and Mutual Funds for two reasons:

Topics: Advisor Practice Management, Behavioral Finance, Systematic Investing

Late last year, it was clear to us as we listened to our clients that a correction in the US markets was a primary concern. There also seemed to be a prevailing wisdom that such a correction, if it occurred, could likely lead to a bear market. While we do not allow the news or anyone’s feelings about markets to influence our investment decisions, we do use them to inform what we analyze and write about. This led to a question. (In my best Dwight K. Schrute voice) “Question: do sharp declines in US Equities act as a precursor to bear markets? False!” The data says they do not.

Topics: Behavioral Finance, Systematic Investing

I returned from a nice long visit to Paris last week, relaxed and without a care in the world. Then I read the news. Yesterday, an investment banker told me he was worried about the Four T’s - Trump, Tariffs, Trade and Turkey. Blueprint is not a macro firm and makes no economic pronouncements, but if your investment portfolio has been riding the wave of up-vol and peak beta (yes, volatility goes in both directions), it is time to make sure that your portfolio includes strategies that will buffer the down-vol, because it is inevitable. A former colleague likes to call these “shock absorbers”. Have you ever ridden in a car without good shocks? It is not comfortable.

Topics: Advisor Practice Management, Behavioral Finance, Systematic Investing

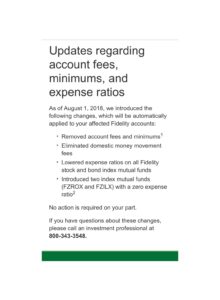

The announcement by Fidelity Investments on August 1st provided the culmination of a trend long in the making. Coincidentally, it is also an idea we have discussed privately for many years, and publicly in this blog since last year – FREE BETA. In what is being hailed as a shocking move, Fidelity has announced the unveiling of two new index funds with a ZERO expense ratio. Vanguard and Blackrock have been offering practically free beta through their ETFs and index funds for years now - but practically free is not free!

Topics: Advisor Practice Management, Systematic Investing

Last May’s blog, in which I shared our observations about the Robo industry, if you can call it an industry, is proving to be on target. You cannot charge a fee for something that should already be free (Beta), and ignore the one thing that you can charge for, advice and a human touch! The list of robos in the graveyard is the proof.

Topics: Advisor Practice Management, Systematic Investing

Like the networks in the summertime who replay their episodes to recycle good material, I thought a revisit of the much discussed and maligned DOL Fiduciary Rule was in order due to its recent vacating by the 5th Circuit Court in New Orleans. With or without the rule, it is time for the industry to step up!

Topics: Advisor Practice Management, Transparency

Ok, now we have seen it all. Maybe.

Imagine if you will, it is again February 2009. The market, perhaps the world, is in a freefall. And you see an incoming call from your brokerage firm that you are relieved to receive, because you really need proactive advice and wise counsel.

Topics: Advisor Practice Management, Behavioral Finance

I am what some would call a nerd – but don’t feel bad for me, I wear this as a badge of honor. As such, I am not normally afraid to work with data and perform deep analysis. However, there was one time where the thought of diving deeper gave me pause for fear of what I might find. In hindsight, my hesitation seems silly given the critical truth I was overlooking. Nevertheless the anxiety was real. For fellow nerds, this is also known as Confirmation Bias, but I digress.

Topics: Advisor Practice Management, Behavioral Finance, Systematic Investing

Back in the dark ages when I started my career in banking, the pace of work and communication was entirely different. Imagine a world with no mail other than what came with a stamp on it or in an interoffice envelope (who remembers those?). Your phone messages came on a pink slip of paper and you dictated your memos. You could actually choose to leave your work at the office. Of course, the biggest change today is that you literally carry your office around in your pocket or a backpack. (Briefcases are gone as well.)

Topics: Advisor Practice Management, Transparency

One hundred million users in the US, a market size of almost $70 billion, and growth rates ranging from 4.8% to almost 10% - these sound like the descriptive statistics of a thriving and successful industry[i]. Perhaps, but consider that the underlying problem this industry is trying to solve is getting worse, not better. I’m talking about the weight loss and diet industry.

Topics: Advisor Practice Management, Transparency

I have the benefit of an insider’s view of many different businesses associated with my family office and private equity work. I sit on a few boards, spend significant time coaching and strategizing with executives, and actually have a few direct private investments myself where I am actively involved in business strategy and development.

Topics: Advisor Practice Management, Transparency

The other day I was speaking with my brilliant friend Liam about the snap back in the market from the almost historic down move, and he reminded me of the question I asked in a blog last November: Do Behavior Bubbles Exist?. I think we have our answer, and in fact, we may have had the then-discussed Minsky Moment. However, it was only a moment, and patient investors sidestepped the market shock and were reminded that a healthy stock market does include a version of volatility that is not always up.

Topics: Advisor Practice Management, Behavioral Finance

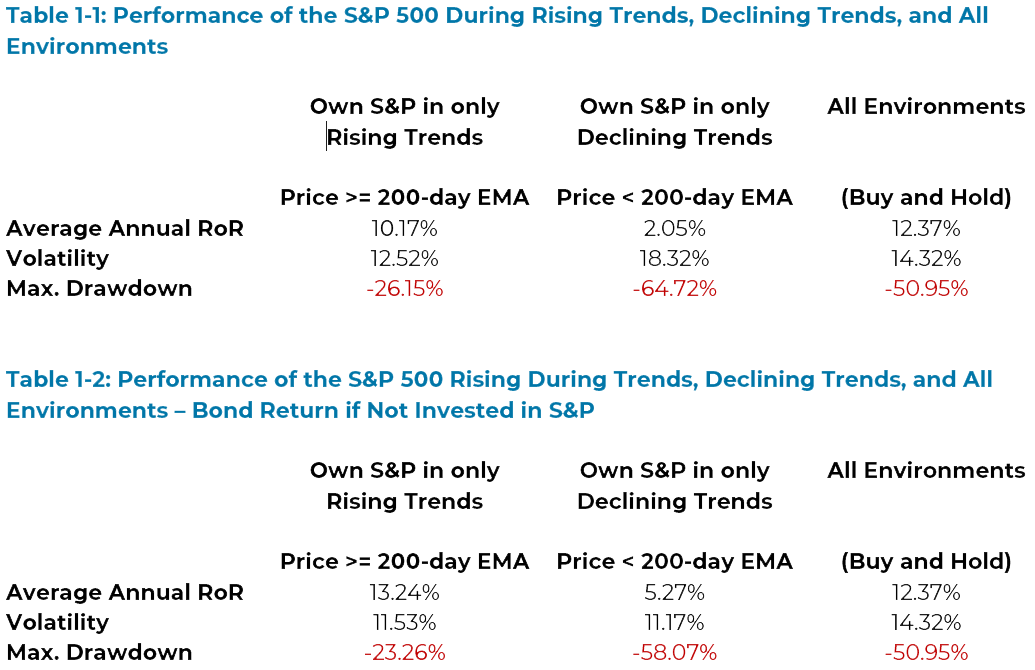

This seldom happens: Equities, bonds, and credit being similarly expensive at the same time. "A condition that is going to translate into pain for investors". (Full Article Here)

Major drawdowns in 60/40 portfolios averaged 26% in real terms, lasted about 19 months, and took almost two years to return to previous peaks.

Topics: Advisor Practice Management, Systematic Investing

A few weeks ago, I attended a family office conference on the West Coast that, as in the past, was comprised of a crowd of industry experts (writer excluded of course), including family office advisors, executives, and top minds from all corners of the investment universe. Being a lifelong member of the East Coast clan, it is always refreshing to have the mix of more traditional thinkers with those far less constrained minds of California.

Topics: Behavioral Finance

For the last several weeks I have been pondering the notion of radical transparency – personally, professionally, spiritually, etc. Much is written about the notion of authenticity in terms of living a life that, in all respects, reflects who you are. Yet we often live in different modes of life where the ‘authentic’ version of us is nuanced for the situation. Transparency, on the other hand, might imply that no matter the place or time, we are sharing our true selves, the details of our lives, and allowing the trust and engagement to build with everyone around us. Add the word radical as an adjective, and you imply that you want your level of transparency to be so thorough that it is transformative in all aspects of your life.

Topics: Advisor Practice Management, Transparency

The Rise of the Machines (and how to retain your advantage) - Episode 3

Episode 3: The Conclusion - Exploit Their Weakness

For the final episode of the Rise of the Machines trilogy, we will dig deeper and get a bit more technical to make our point – that elite advisors will see this evolution as an opportunity, not a threat. As you recall, in Episode 1 we discussed the power of objectives-based financial advice, and that embracing investment technology is a component of the path to successfully confronting the changing landscape and retaining the human advantage. In Episode 2 we defined advisor’s advantages over robots, what sets engaged human advisors apart, and what the advisor “deliverable” looks like.

Topics: Advisor Practice Management, Behavioral Finance

The Rise of the Machines (and how to retain your advantage) - Episode 2

Episode 2: Define Your Superiority

In Episode 1, we discussed how elite Advisors are focused on achieving client goals while living in a rapidly changing environment – today many investment services that were once high value are now freely/cheaply available. (To read Episode 1, click here.)

In Episode 2, we want to describe what sets Advisors apart from the robots, and highlight client motivations for investing (with people!). Most importantly, we offer ideas for how Advisors can cement their advantage over the robots by improving the overall client experience.

Topics: Advisor Practice Management, Behavioral Finance

The Rise of the Machines (and how to retain your advantage) - Episode 1

Episode 1: Understand Their Appeal

Elite Advisors focus on one thing – achieving their client’s financial goals.

Particularly now, when market returns and basic portfolio optimization techniques have become commoditized and are no longer competitive advantages, it is critical that Advisors deliver on this promise for their clients. From a wealth management perspective, it is not good enough to simply buy and hold a portfolio of investments, whether expensive and actively-managed mutual funds, or cheap and passive ETFs. If the average investor can achieve a market return for essentially nothing, then shouldn’t the elite advisor instead provide the highest probability of meeting or exceeding the financial goal as their investment deliverable?

Topics: Advisor Practice Management, Behavioral Finance

After more than 25 years in the financial advice world it appears to me our industry is finally growing into adulthood. For the first time, all financial advisors must now conduct business in a manner appropriate to the incredible responsibility allowed us by our clients. Simply put, the industry will require itself (thanks for the nudge Uncle Sam!) to put a client’s interests first in the recommendation and implementation of financial strategies and plans. Seems pretty straightforward right? Apparently only if this level of diligence DOES NOT get in the way of the advisor making his Mercedes lease payment (name your indulgence here). I have been asked many times by friends and clients – ‘hasn’t this always been a rule?’ Well no, but it should have been.

Topics: Advisor Practice Management, Transparency

In 1998, during the peak of the dot com boom and only a few short years after Al Gore invented the internet, I was an executive in the private bank of a large financial institution in the Southeast. We were staring at the opportunity to begin to utilize technology as part of our client service delivery, and at the same time intimidated by the change that would lie ahead. I led a team that created one of the first integrated wealth management strategies in the industry, and our business model has been replicated many times over in the last 20 years or so.

Topics: Advisor Practice Management, Transparency, Systematic Investing

In November, The Ringer’s Danny Chau published an article about the unique abilities of NBA superstar James Harden, whose absurd level of play this season has made him an MVP favorite. In the piece, Chau recounts a conversation with Dr. Marcus Elliott of P3 Applied Sports Science, a performance facility that uses advanced technology to test the physical capabilities of athletes. According to Elliott, “Harden is barely average in almost every metric we look at related to athleticism, except for deceleration metrics. And in those he’s one of the best athletes we’ve ever measured in any sport — in soccer, football, or basketball.” In other words, Harden is world-class at slowing down. The Houston Rockets’ All-Star guard does not need to out-run, out-lift, or out-jump his opponents to beat them off the dribble- Harden’s preternatural ability to stop on a dime allows him to create the space he needs to score while his defenders fly into the first row of the stands.

Topics: Behavioral Finance

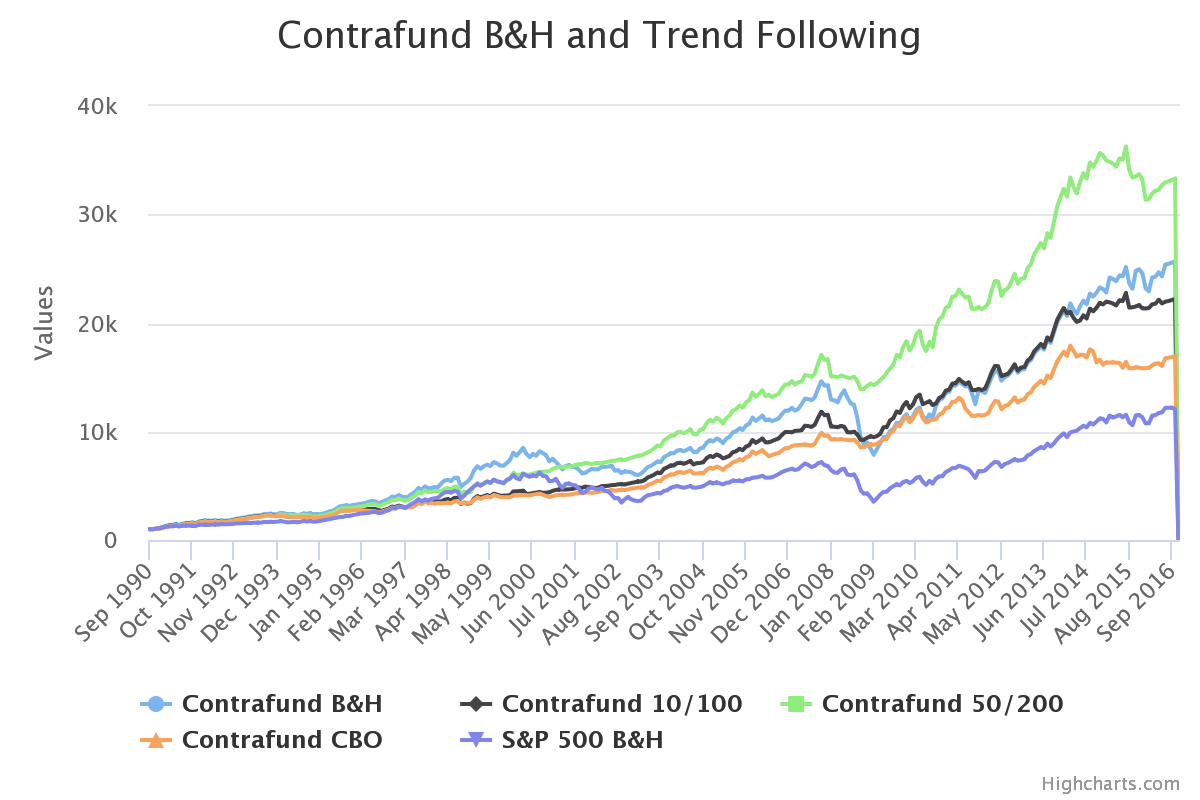

The Wall Street Journal recently published a profile piece about Will Danoff, the manager of Fidelity’s Contrafund (FCNTX), which got us thinking. As stated in the piece, the $108 billion Contrafund has averaged a 12.7% annual return since Danoff took over the fund in September 1990, outperforming the S&P 500 index by 2.9 percentage points per year. Contrafund’s performance has indeed been tremendous, as shown in the following graph when compared to the S&P 500:

Topics: Systematic Investing

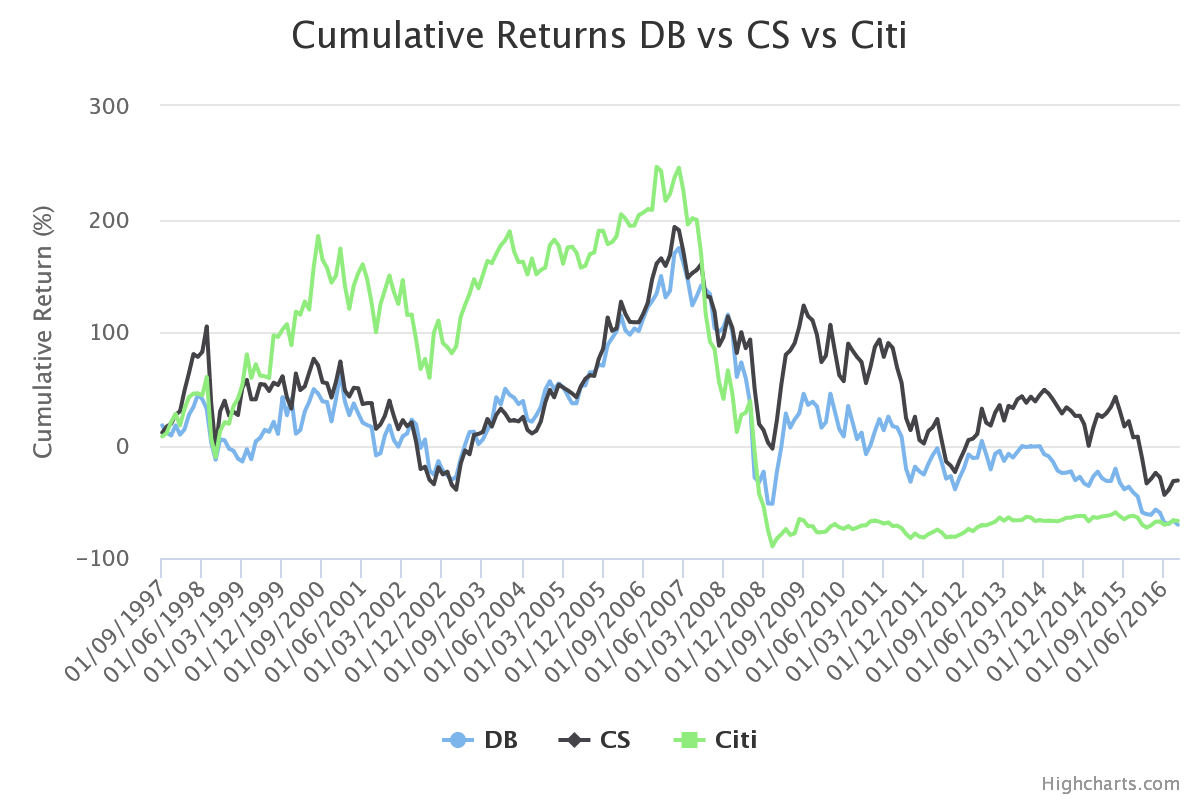

As media outlets, governments and markets react to the continuing troubles of Deutsche Bank (NYT, BBC, Bloomberg, Atlantic), our research staff was both eager and curious to examine the potential impact of adding a trend following system to DB’s stock, as well as to those of fellow sector firms Credit Suisse and Citigroup. The recent woes of these companies should come as a surprise to few – consider the following graph of cumulative returns since September of 1997, paying particular attention to the last 3 years:

Topics: Systematic Investing