It took some painful contortions in the markets this year for many advisors to realize robo-advisors may not be as diversified and risk-managed as they claim.

At Blueprint, we believe there is a “sweet spot” between the rudimentary machinations of a robo-advisor and a more traditional asset allocation method. In fact, we’ve bet our business on it. But, this briefing isn’t meant to say, “I told you so,” rather to articulate a solution to a problem that many well-intentioned advisors are contemplating.

Read More

Topics:

Behavioral Finance,

Systematic Investing

A confession: Without CliffsNotes, I may not have made it through high school…or college. In fact, until just recently, I actually thought it was “CliffNotes” (no “s”) – but I digress.

If you’re like me, these very valuable summaries are extremely helpful and efficient. With that in mind, I wanted to share three takeaways from a financial services virtual event last week, all of which struck me as highly relevant for elite financial advisors.

Read More

Topics:

Advisor Practice Management

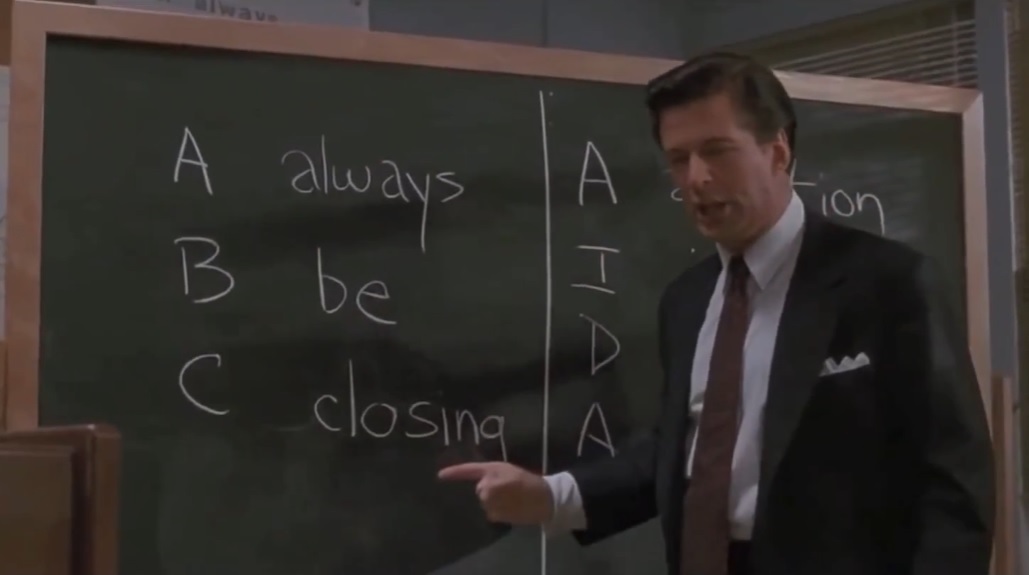

I'll start off by saying that prior to joining Blueprint, I was nicknamed "MC Spammer."

Yeah, that's right.

It was funny…at first.

In fact, I joined Blueprint because I knew there had to be a different way of engaging and partnering with advisors: no scripts, no "hard close," just creating value, and permitting interested advisors to reach out to us. But, for this approach to work, buy-in and patience is required – everyone on the team must be onboard.

Read More

Topics:

Advisor Practice Management

When I first joined the team here at Blueprint, there were several "Ah ha" moments that stood out. Coming in, I considered my role as National Sales Director to be leading the effort to broadcast the power of Blueprint’s sophisticated, yet simple story. As I reviewed our existing marketing materials, I noticed a chart comparing our Growth strategy (an 80/20 stock/bond model at its baseline) to a traditionally allocated Balanced portfolio.

Read More

Topics:

Advisor Practice Management,

Behavioral Finance,

Transparency