When I first joined the team here at Blueprint, there were several "Ah ha" moments that stood out. Coming in, I considered my role as National Sales Director to be leading the effort to broadcast the power of Blueprint’s sophisticated, yet simple story. As I reviewed our existing marketing materials, I noticed a chart comparing our Growth strategy (an 80/20 stock/bond model at its baseline) to a traditionally allocated Balanced portfolio.

Before joining the team, one of the most attractive attributes of Blueprint was its commitment to education and telling a simple story. However, I was puzzled why the otherwise brilliant team would make such a glaring mistake. I told our CEO Jon Robinson I thought the piece looked good but used the wrong benchmark. Surely, you would use an 80/20 model when comparing to our Growth strategy...?

Nope.

Simplicity Meets Math

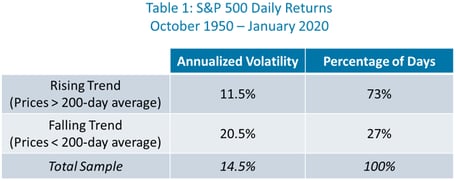

Jon first explained that when you employ a strategy designed to bypass a significant portion of the downside, your risk/reward characteristics are different than that of a passive or static portfolio. Historically markets (particularly equities) fall at a rate approximately 2 times faster than they rise as illustrated here. Despite the fact that equity markets trend upwards almost three-quarters of the time, when they fall volatility expands rapidly and the downtrend is more severe. Therefore, if you capture say 80% of upward trending markets and 50% of downward trending markets, you have a more favorable return/volatility profile.

Jon first explained that when you employ a strategy designed to bypass a significant portion of the downside, your risk/reward characteristics are different than that of a passive or static portfolio. Historically markets (particularly equities) fall at a rate approximately 2 times faster than they rise as illustrated here. Despite the fact that equity markets trend upwards almost three-quarters of the time, when they fall volatility expands rapidly and the downtrend is more severe. Therefore, if you capture say 80% of upward trending markets and 50% of downward trending markets, you have a more favorable return/volatility profile.

Jon went on to explain that from a volatility or risk perspective the more appropriate benchmark is a Balanced benchmark (~ 50/50 or 60/40) as it would essentially equal our growth model from a standard deviation and max drawdown perspective – over full market cycles. By reducing volatility without excessively compromising returns, advisors have the option to allocate clients previously relegated to balanced and conservative allocations towards growth and moderate growth profiles.

In an environment where both equities and fixed income are at all-time highs, this is a great option to have. My response: "Jon, this is a profoundly important benefit of what we do”! It was funny to me that this was NOT front and center on our website.

Reminds me of a quote by Marcel Proust, “The real voyage of discovery consists not in seeking new lands but in seeing with new eyes.” My eyes!

Our Focus is the People

We often talk about the importance for advisors to focus on client goals and overall financial well-being. The industry refers to this as goals-based investing and we see it as the holy grail for advisors. Thoughtful financial planning leads to a return objective aligned with client goals, and NOT a market benchmark.

Study after study shows that when advisors spend their time on the highest impact activities (client planning, business development and leadership) and outsource nearly everything else, their clients and therefore their businesses thrive. In the case of managing client investments, partnering with Blueprint allows advisors to not only confidently delegate these responsibilities but to do so in a way that strongly aligns with satisfying client goals.

As I continue to process these simple, yet profound elements of Blueprint’s process, I am reminded that the landscape for advisors and investors to select investments has never been noisier. For some it may be overwhelming. The truth is there's a lot of product options out there. Further, these products are getting less expensive and more directly accessible by investors. Obtaining a market return has never been easier. So, the challenge for advisors and investors is cutting through the noise to find the optimal solution that best serves the client. This is where we add the most value.

Simplicity Matters – For Advisors AND Clients

At Blueprint, we keep it simple. We won’t have a big sales team, an aggressive marketing culture, or anyone telling you that you NEED to have ‘this’. Blueprint is different. We believe in our story. We believe there is a way to market a unique process where we stand out as people first and asset managers second.

We believe by creating something compelling, transparent, and fairly priced, people will find it, eventually. We do think if you take a look you might come to that conclusion on your own – and that’s exactly how we think it should be.