The other day I was speaking with my brilliant friend Liam about the snap back in the market from the almost historic down move, and he reminded me of the question I asked in a blog last November: Do Behavior Bubbles Exist?. I think we have our answer, and in fact, we may have had the then-discussed Minsky Moment. However, it was only a moment, and patient investors sidestepped the market shock and were reminded that a healthy stock market does include a version of volatility that is not always up.

Humanity Strikes Again

What is also not surprising is the reason for the volatility – human bias. Over the past few years, complacency has reigned, and investors have sought out ever more exotic ways to trade this market. Even many so called defensive managers whose role in a portfolio was to provide a ballast in a market shock, or even alpha in a crisis, found their bias to get longer the market the farther along the bull ran. They had a rough few days I imagine.

You Shorted What?

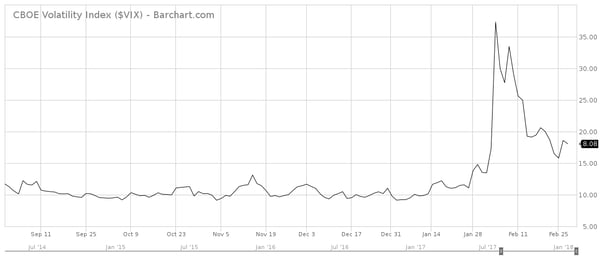

Source: Barchart.com. For illustrative purposes only. Past performance is not indicative of future results.

What most did not realize, however, is there was a huge group of ‘investors’ shorting volatility and making a killing – until they didn’t. If you are short vol and long the S&P when the above happens, your significant other is not going to be happy with you. Nevertheless, this was generally a trade made knowingly by folks using their own capital. Generally. Of course, our capital markets are proficient at creating products that in theory seem useful and harmless, yet in practice are misused because they are misunderstood. The XIV ETN (RIP!) was one such product that evaporated about $3 billion in value in a couple of days. Thanks, Credit Suisse, for thinking this was a good idea.

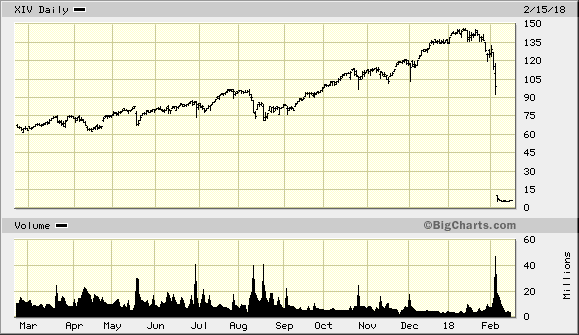

Source: BigCharts.com. For illustrative purposes only. Past performance is not indicative of future results.

“It worked well for a long time – until it didn’t”. - Credit Suisse CEO Tidjane Thiam

This ETN became an absurd way for the average and unwitting investor to express a more complex trade. Did they have any idea that an ETN and an ETF are not created equal? Did anyone, even the so-called sophisticated people, realize the instrument was a derivative of a derivative of a derivative? Remember CDO-Squared? Yes, mere mortal investors wanted to get in on the action and let greed kick in. Folks, this was not a trade to be long - ever! And these types of products are not created during bear markets – rather they are bait for bias in a bull market.

Holding the Steering Wheel Too Tightly

As a quant shop, we have had our fill of press the last couple of weeks about how trend following is dead, and quants are the reason for the market drop. In part, this is true, but not all quants are created equal. In the quest to balance the sometimes-conflicting factors of investment performance and human behavior, time frame matters. As my partner Jon Robinson says, “your systems need to fit the market like a mitten, and not a glove.” It is evident that a number of funds and traders were closely linking their moves to the VIX, which has been historically low for a long time. And, as disciplined systems will do, they reacted violently and took it on the chin when the VIX went parabolic. Our guess is that many allowed the poison known as human emotion to get involved. The data will tell you the story if you go looking, but there is a huge difference between a shock and a drawdown (see prior blog post on this topic). If you have a longer investment horizon, most intermediate and long-term systems watched the gyrations from afar. This is our preference, and thus not all quants are the same.

Lessons Learned

Transparency matters – if you cannot explain an investment such that your mother would understand it, you might reconsider.

Timeframe matters – investments must be aligned with your goals, and not the other way around. Ignore the shocks and beware of the bears.

Bias is poison – the reason trends and bubbles occur is because humans will always be humans, and thus you need a plan to insulate you from your innate bias.

….and I am sure there are many others.

As we end February within sight of previous highs, it could be argued that this note is easy to write – the benefit of the rear-view mirror if you will. What I can tell you is for a few days we were all wondering if this Bull was changing direction for good and breaking trend. Fortunately, our disciplined and systematic approach allowed us to keep our emotions at bay. The owners of XIV were not so lucky.

By Tommy Mayes

For more thoughts on ways to evolve your investment approach visit www.blueprintip.com

Recommended reading: