If you are paying any attention to the media the last few weeks you know at least two things: China and the United States are having a tariff standoff, and the market (AKA all things tradeable) is having a rough end to the summer. On the latter point, why does volatility to the downside drive so much hysteria and so many prime time CNBC specials? I believe it is simply because we are all human.

If you are paying any attention to the media the last few weeks you know at least two things: China and the United States are having a tariff standoff, and the market (AKA all things tradeable) is having a rough end to the summer. On the latter point, why does volatility to the downside drive so much hysteria and so many prime time CNBC specials? I believe it is simply because we are all human.

Should We Just Turn Off the TV?

Even the most veteran market participants waver in the face of 3% down days and a historic high price on the 30-year Treasury, not to mention the daily tariff rhetoric and the uncertainty created by it. However, there is a difference between how you are prone to react as a human and how you should behave as an investor. I heard several talking heads say the other night, ‘just ignore your emotions and make the trade.’ Does it strike you how silly that advice sounds? Part of what makes us human is our emotional capacity. However, as investors that capacity can and often does work against us. Consequently, when the media is hyperventilating about the volatility of the day, it is not surprising that even the most convicted investor can second-guess their strategy.

Strategy + Advice = Success

This is precisely why having a good financial plan matters. It is also why elite financial advisors are worth their weight in gold. Successful investing must be paired with good overall financial planning so that the objectives are clear and the investment strategy is aligned with those goals. Combining a solid plan with a strategy designed for the emotional human creates a process for maximizing compounding. And why is that important?

The Power of Compounding

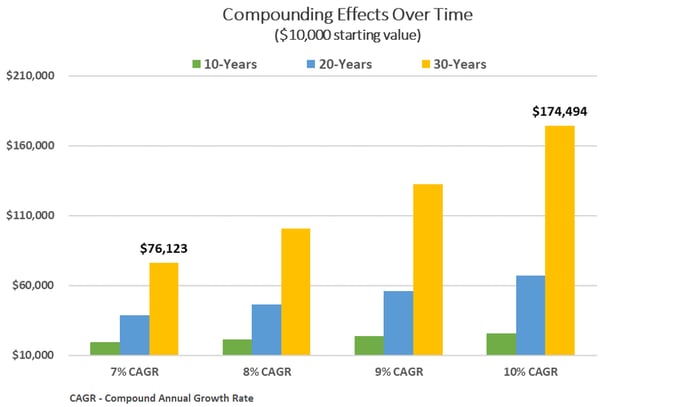

Advisors that help investors stay on track and focus on their goals and not the market allow their clients to participate in what has been called the eighth wonder of the world – COMPOUNDING. Coupled with a thoughtful investment strategy and risk management, compounding allows disciplined investors to grow from ever higher levels of value and build towards their goals exponentially over time, even in the face of market drama.

The graph illustrates the effects of compounding – how, while keeping the annual growth rate consistent, doubling or tripling the investment timeframe will more than double or triple the final portfolio value. Charlie Munger was quoted saying, “the first rule of compounding is to never interrupt it unnecessarily.” We believe that pursuing what might be considered an inferior strategy (ex. Buy and Hold) consistently is more effective than attempting to avoid volatility entirely by moving to the sidelines.

Volatility is a Necessary Evil

So, where does this take us as it relates to Volatility vs the Human? Returns on investments involve risk, and that risk is often equated to the volatility of value. But volatility goes both ways – not just down. We naturally celebrate UP VOL, and waver in the face of DOWN VOL. Yet, as a practical matter, you cannot have one without the other. To the extent an investor becomes caught up in the emotional aspects of a fickle market, and changes strategy or retreats to the sidelines, they lose the long-term momentum of the market and the power of compounding.

Invest with Emotional Intelligence

At Blueprint, we build emotionally intelligent strategies that provide advisors and their clients with the type of investment experience that allows for the practical aspects of human emotion and the disciplined results of a seasoned investor.

In the face of volatility, respect your own humanity while also trusting your plan and your advisor.

For more thoughts on ways to evolve your investment approach visit www.blueprintip.com

_____________________

Recommended reading:

Riding the Waves of Risk – Blueprint.com Insights 3/28/2019

Howard Marks – On The Other Hand - OakTree Capital Insights