Episode 3: The Conclusion - Exploit Their Weakness

For the final episode of the Rise of the Machines trilogy, we will dig deeper and get a bit more technical to make our point – that elite advisors will see this evolution as an opportunity, not a threat. As you recall, in Episode 1 we discussed the power of objectives-based financial advice, and that embracing investment technology is a component of the path to successfully confronting the changing landscape and retaining the human advantage. In Episode 2 we defined advisor’s advantages over robots, what sets engaged human advisors apart, and what the advisor “deliverable” looks like.

In Episode 3, we remind readers of robot limitations while also making the case for using Blueprint’s focus on price trends to make asset allocation decisions. We believe this use of investment technology will improve the results that advisors are expected to provide to their clients, and increase the probability of achieving their financial objectives.

In addition to lacking the human touch that is critical to a successful advisory practice, the robots (or at least the most popular versions at this moment) have a fatal flaw. For all the operational and cost efficiency robots provide, they surprisingly suffer from a severe lack of risk management. To be fair, we have also seen deficiencies in the level of risk management employed at many human advisory practices, but the distinction is that the human advisor can help coach clients through rough patches in the market, no matter how painful. Robots have no such ability. We believe this will cause upheaval among robo-users (and subsequently robo-advisors) when the next, inevitable bear market occurs. Candidly, there cannot be enough phone lines at Vanguard or Wealthfront, or any of the others, to address the human fears resulting from a true market correction. And therein lies the opportunity.

How Time Diversification (Trend Following) Improves the Probability of Meeting Your Client’s Objectives

As discussed, elite advisors focus their clients on achieving their objectives, and market returns are only a reference point. How do they get there? By providing strategies that smooth the return profile and reinforce the position that market risk is necessary to achieve a return. Advisors simply need to employ a robust process to support the effort.

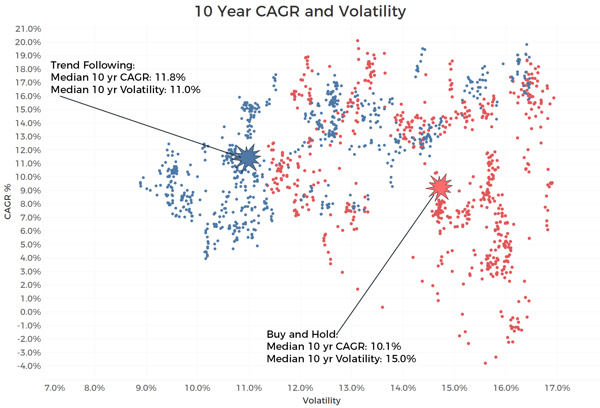

Figure 1 below plots ten-year compound returns (horizontal axis) of the S&P 500 (Total Return) versus its annualized volatility (vertical axis) over the same period since 1950. Results in blue represent a passive, buy-and-hold approach while green represents a simple trend following system using moving averages. For more about the specific rules behind the trend following approach, click here.

As one can see, passive investors experienced a wide range of outcomes with multiple ten-year periods of negative return, which can be devastating to the investor psyche, not to mention the lost compounding of positive returns. If you utilize a traditional buy-and-hold approach, regardless of the focus on value, growth, or any other factor, the blue area will roughly represent a similar distribution of portfolio returns and ensuing volatility given the relatively high correlation between each of those factors. Now, contrast the results in blue with those in green. As Table 1 below shows, disciplined execution of a price-focused, rules-based process improves the odds of achieving the client’s return objective by reducing (in this case eliminating) negative returns over the ten-year samples in this study, while also lowering volatility. A risk management system based on trend tightens the distribution and shifts the outcomes towards a higher median/expected return and a lower average volatility.

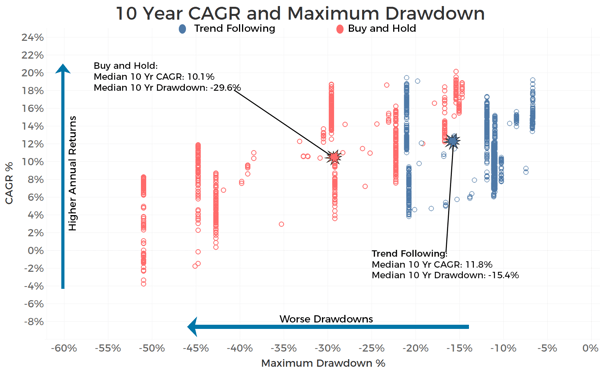

Another way of viewing this data is by plotting the 10 year returns with maximum historical drawdowns instead of volatility shown below in Figure 2. Both volatility and drawdown are good measures of the pain experienced to achieve the goal return. The higher the volatility and/or worse the drawdown, the more ‘coaching’ needed by the advisor, and the greater probability that the investor abandons the strategy (aka calls in a panic and says to go to cash). As with volatility, a passive approach (red) produces a wide range of outcomes since 1950, with several periods that have proven difficult for even advisors, much less their clients, to stay the course.

Now contrast again with the results of using trend following (green). Perhaps even more so than with return vs. volatility, return vs. drawdown amplifies the benefit of a trend-based risk management process. The distribution of outcomes tightens significantly and the worst case (vertical axis) is cut in half. This again speaks to the ‘experience’ that an advisor can provide an investor by keeping them on track and reducing the impact of crisis periods in the market without sacrificing return.

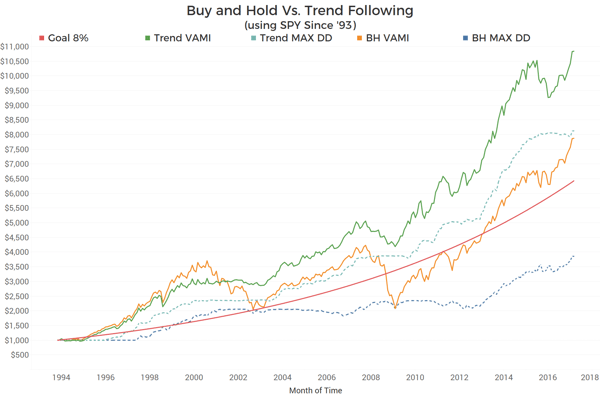

One final view brings into focus the impact of trend vs buy and hold in dollar terms. Figure 3 below shows the value of a $1,000 investment for three different scenarios. The green line represents a smooth 8% annual, compounded return - the investment goal line. If an advisor can produce 8% over a lifetime of investing for a client then we believe almost any reasonable financial goal can be achieved. The next two lines are the solid blue and red. The blue line is the account value for an advisor/investor buying and holding the S&P 500 ETF (SPY) since its inception in 1993. The red is a trend-based approach on SPY.

One should not focus on the raw outperformance because that will vary based on the period in question. It just so happens that this period includes two large bear markets in which a trend-based process would clearly outperform versus buy-and-hold.

Instead, focus on:

- The relative smoothness of the trend-based approach, and perhaps most importantly

- The two dashed lines representing the account value of each scenario assuming it repeats its maximum historical drawdown.

Therefore, a trend-based investment process could more easily endure a repeat of its worst period, all else equal, and still perform above goal, while a buy-and-hold strategy could not. Even now, after approximately 10 years of a bull market for equities, a passive approach is one drawdown away from being woefully off-target. A drawdown that has occurred twice in the last 20 years, we should add.

The previous charts also illustrate the importance of benchmarking with a goals-based focus. Elite advisors must design a benchmark for clients putting investment performance in view of the appropriate time horizon and asset class mix – if they don’t, CNBC or friends and neighbors will do it for them! Our experience is that a lack of a thoughtful benchmark almost always results in a comparison to the Dow Jones Index or the S&P 500. Further contributing to the error, performance is then evaluated over very short, random time frames. As the chart shows, not only can be this create a bad comparison, but it also will directly conflict with the achievement of financial goals.

What then, is the Conclusion?

As previously discussed, robos and indexes are generally designed to efficiently (and cheaply) return whatever the broad market provides. Blueprint has developed a reliable process with similar attributes that advisors can deploy, and expand their competitive advantage of objectives based advice, but within a risk-managed framework. After all, isn’t winning at investing like winning at archery? Hitting the bull’s-eye with one shot and then missing the board entirely with the next is not a successful business strategy for advisors. The objective is to deliver consistent returns in a repeatable way, no matter the economic or market environment. To extend the metaphor – hit the target every time within a much tighter pattern, thus scoring the most cumulative points over the match.

Advisors face a unique environment that will require a higher level of service to sustain and grow their practices. Advisors who are selling market returns (beta) are at risk of becoming obsolete due to the number of options that can provide the same outcome far less expensively. Points of value once exclusively provided have now been commoditized and made cheaply available to investors. It is no longer just a case of outperforming the other advisor down the street or across town. Advisors compete essentially globally and must justify their fees versus national Robo brands and the ever popular do-it-yourself “Vanguarding”. In the end however, the same technological advances that jeopardize their practice also provide an opportunity to more consistently achieve the primary mandate - to help clients meet their financial objectives.

Learn how partnering with Blueprint can benefit advisors in a way that sets them apart, while also freeing them up to focus on the things that their clients no doubt value the most anyway – advice, communication and relationships. Click here to schedule a call.

Blueprint Investment Partners is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. For more information please visit adviserinfo.sec.gov and search for our firm name.

Information obtained from third-party sources is believed to be reliable though its accuracy is not guaranteed.

Information contained on third party websites that Blueprint may link to are not reviewed in their entirety for accuracy and Blueprint assumes no liability for the information contained on these websites.

This website and the data herein is not a solicitation to invest in any investment product nor is it intended to provide investment advice. It is intended for information purposes only and should be used by investment professionals and investors who are knowledgeable of the risks involved. No representation is made that any investment will or is likely to achieve results comparable to those shown or will make any profit at all or will be able to avoid incurring substantial losses. While every effort has been made to provide data from sources considered to be reliable, no guarantee of accuracy is given. Historical data are presented for informational purposes only. Investment programs described herein contain significant risks. A secondary market may not exist or develop for some investments portrayed. Past performance is not indicative of future performance.

Investment decisions should be made based on the investors specific financial needs and objectives, goals, time horizon, tax liability, risk tolerance and other relevant factors. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Investors should consider the underlying funds’ investment objectives, risks, charges and expenses carefully before investing. The Advisor’s ADV, which contains this and other important information, should be read carefully before investing. ETFs trade like stocks and may trade for less than their net asset value. Blueprint Investment Partners, LLC (“Blueprint” or the “Advisor”) is registered as an investment adviser with the United States Securities and Exchange Commission (SEC). Registration does not constitute an endorsement of the firm by the SEC nor does it indicate that the Adviser has attained a particular level of skill or ability.

Indexes are unmanaged and do not incur management fees, costs, and expenses. Blueprint’s risk-management process includes an effort to monitor and manage risk, but should not be confused with and does not imply low risk or the ability to control risk. There are risks associated with any investment approach, and Blueprint strategies have their own set of risks to be aware of. First, there are the risks associated with the long-term strategic holdings for each of the strategies. The more aggressive the Blueprint strategy selected, the more likely the strategy will contain larger weights in riskier asset classes, such as equities. Second, there are distinct risks associated with Blueprint Strategies’ shorter-term tactical allocations, which can result in more concentration towards a certain asset class or classes. This introduces the risk that Blueprint could be on the wrong side of a tactical over-weight, thus resulting in a drag on overall performance or loss of principal.

International investments may involve additional risks, which could include differences in financial accounting standards, currency fluctuations, political instability, foreign taxes and regulations, and the potential for illiquid markets. Investing in emerging markets may accentuate these risks.

Diversification strategies do not ensure a profit and do not protect against losses in declining markets.