The New 20-Year Stock Chart

The last 20 years have given us three major market shocks. These resulted from the end of a tech bubble, a financial crisis and now, a global pandemic. During this time, investors have experienced numerous emotional highs and lows, yet in general, the approach to investing delivered by the financial services industry has not fundamentally changed.

We think that’s a problem.

And this blog makes a case for why the status quo should change.

The Power of Belief

“The most difficult subjects can be explained to the most slow-witted man if he has not formed any idea of them already; but the simplest thing cannot be made clear to the most intelligent man if he is firmly persuaded that he knows already, without a shadow of a doubt, what is laid before him.”

Leo Tolstoy

What stands out to me about the above quote is the power of BELIEF. It is the idea that anyone can learn something if they resolve to have an open mind, but even the most intellectually gifted person will struggle with new concepts if they hold on to existing ideas too tightly.

While I like Russian literature as much as the next guy, as a resident of North Carolina, I prefer the following quote, which carries a similar message:

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

Mark Twain

Equity Obsession

As an asset class, U.S. stocks are the undisputed standard for long-term investing. I have not traced the lineage to the origins of this belief, but it has clearly been the case for my entire life. And if U.S. stocks are the preferred WHAT in investing, then buy-and-hold is the predominant HOW.

You frequently hear prognostications on CNBC and other news outlets about individual stocks that should be bought and sold, but the overarching theme for American investors is buy stocks, hold stocks, rinse, and repeat.

Even among target-date or lifecycle-based funds aimed at creating an automated glidepath toward retirement, stocks are the prevailing investment right up until the latter stages of the investment cycle. In fact, we noted in a blog last year that the target allocation to stocks in most lifecycle funds has INCREASED since the Financial Crisis, not decreased.

As a firm highly curious about behavioral finance, we find this obsession with one type of investing and in one particular asset class fascinating.

A Blind Investment Taste Test

Is this characteristic of the prevailing American investing psyche more a function of investors deciding to buy stocks, or one of being sold stocks?

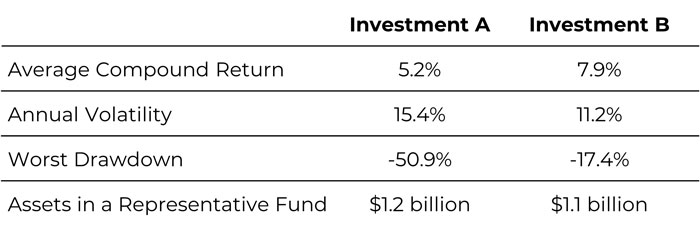

To think about this question, let’s start by looking at two investments going back to the beginning of this century.

Investment Performance Comparison

Investment B provides a better return with significantly less volatility and a fraction of the drawdown.

While both are considered mainstream investments, Investment A is a fixture as the largest holding in many mainstream investment portfolios, but Investment B is generally relegated to a minor allocation at best. As you might guess by now, Investment A is U.S. stocks, in this case represented by the Vanguard Total Stock Market Index Fund (VTSMX). Investment B? It’s the Vanguard Long-Term Treasury Fund (VUSTX). That’s right, U.S. bonds – and not even of the corporate variety.

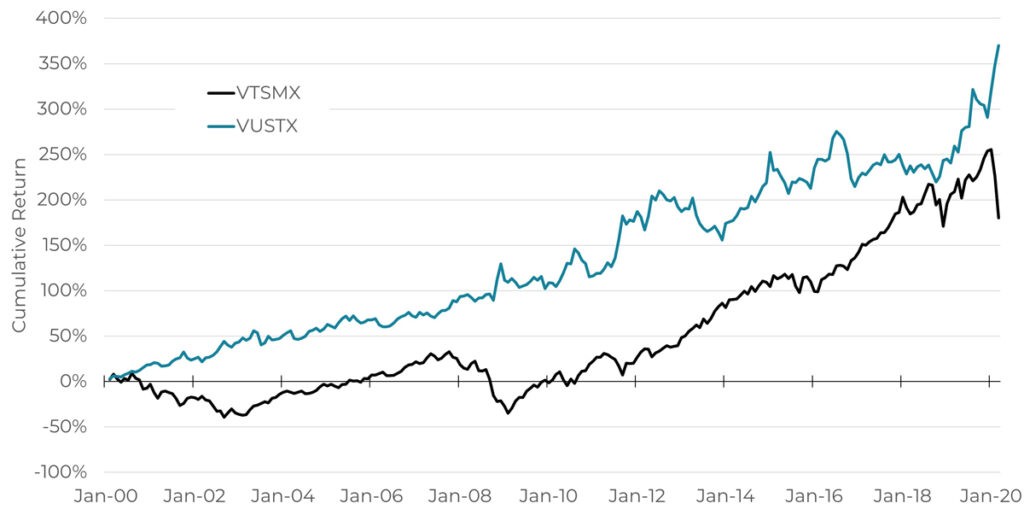

The New 20-Year (Plus 3 Months) Stock Chart

Equities & Bonds: Cumulative Returns Since 2000

So, what’s the point? With interest rates at near-zero for the last decade, will bonds repeat this performance? It is highly unlikely, in our view, which tells us a different approach may be needed going forward.

As our readers know by now, we are clearly not bond traders or advocates for changing the 60/40 portfolio to a 40/60 portfolio. In fact, we frequently refer to the 60/40 problem, which is to say we think this commonly used approach has failed to achieve its stated goal over. Moreover, we generally use equities as our primary means to generate returns, even if we are not fixated on them.

The point of calling out this dominant perception in American investing against the backdrop of Tolstoy and Twain’s musings is to hopefully encourage financial advisors to take a step back and open their minds to different forms of asset management. For example, our style of asset management uses a systematic investing process to continually adapt how the portfolio weights equities, bonds, and other asset classes based on current market conditions.

Going with the flow may sometimes be an adequate way to manage a portfolio, but as the recent Coronacrash has taught us, things are not always what they seem – and change can come quickly. We think our systematic investing process is well-equipped to adapt to change.

The Implications

As risk managers, we believe relying on one asset class and one style of investing to deliver the lion’s share of performance needed to meet an investor’s goals is unnecessary and potentially harmful.

Consider that the most recent 20 years (plus three months) in the Vanguard Total Stock Market Index Fund (through March 2020) has produced a compound annual growth rate of 5.2% with three peak-to-trough drawdowns of greater than 35%.*

For investors beginning their accumulation phase in the early 2000s, it seems highly unlikely that the expected return needed for retirement could be less than 5%, which is the equity return noted above. This also assumes that a client would exhibit exceptional fortitude and be able to sit through those emotionally charged periods, which is also unlikely.

We believe there is a better way.

The Action Required

Investment decisions are often made emotionally and justified intellectually.

If we flip the order and first start from an intellectual standpoint, history tells us that a new approach to asset allocation could achieve two things:

- Increase the probability of achieving a client’s investment goal

- Better management of a client’s emotions during future shocks in the market

We hope this serves as a prelude table for additional thoughts and discussions in the future.

*Source: ICE, Vanguard Total Stock Market Index Fund, 1/1/2000 to 3/31/2020

Brandon Langley

Let's Talk

If you’d like more information about the systematic investing process used by Blueprint Investment Partners