My colleague, Brandon Langley, and I began writing about the pitfalls of a traditional 60/40 portfolio back before it was trendy. He and I felt so strongly about the topic that we published a white paper in August of 2018. Some considered us renegades back then for having the audacity to question what had been the bread-and-butter strategy that helped millions of investors retire comfortably.

But the question is: Will the 60/40 allow the next generation of investors to also retire well?

Now it’s generally accepted that a 60/40 portfolio leaves much to be desired from a risk and return perspective. Some advisors may be considering alternative solutions they can implement on behalf of their clients.

Now it’s generally accepted that a 60/40 portfolio leaves much to be desired from a risk and return perspective. Some advisors may be considering alternative solutions they can implement on behalf of their clients.

Revisiting The Original Assumptions 2+ Years Later

With the benefit of a little hindsight and a lot more months of concrete data, Brandon and I recently updated our white paper. He and I think this is more than getting the band back together for the purposes of nostalgia. And this is not a victory lap.

Instead, having access to more data — and within such an extraordinary time in market history — has allowed us to recheck our assertions. Despite the historical uniqueness of the current market environment, we found that the problems associated with a 60/40 portfolio remain as relevant now as it was in 2018, if not more so.

120 Years of Data within 4 Interest Rate Regimes

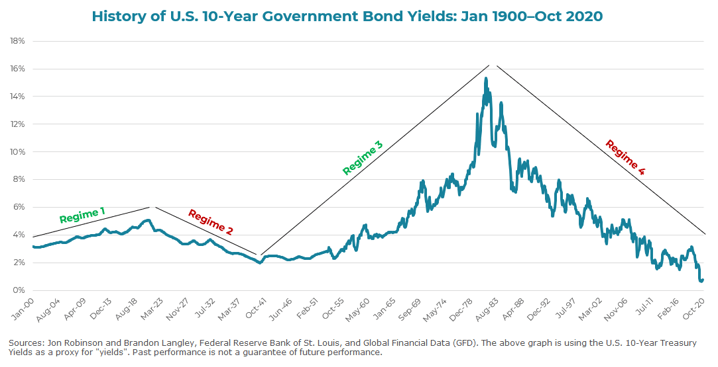

The re-release of "The 60/40 Problem: Examining the Traditional 60/40 Portfolio in an Uncertain Rate Environment" begins with an examination of historical Sharpe ratios, a measure of return versus risk, since 1900.

The data demonstrates a divergence between stocks and bonds in both absolute and risk-adjusted returns. This is true for the overall sample and when you slice up the data to look at the four unique interest rate regimes within the 120-year data set — two rising rate environments (January 1900-January 1921 and February 1941-September 1981) and two falling rate periods (February 1921-January 1941 and the one that began in October 1981).

Brandon and I then analyzed whether the addition of trend following could benefit a traditionally allocated portfolio during rising and/or falling rate environments. Looking at compound annual growth rate, annualized volatility, max drawdowns, and Sharpe ratios, we think the data shows that adding a trend following strategy to a buy-and-hold portfolio could increase positive outcomes on both an absolute and risk-adjusted basis in both rising and falling interest rate environments.

The findings highlight that it’s prudent for advisors to explore incorporating efficient, robust risk management processes to solve their 60/40 problem, especially because of the historical uniqueness of the current period for traditional asset classes.

Landline Phones, 8-Track Tapes & the 60/40 Portfolio

Like a landline telephone or an 8-track tape, the 60/40 may still technically function – but may not be as effective as the alternative.

Brandon and my research showed in 2018, and it still shows in 2021, that introducing time diversification (aka trend following) may improve the risk-adjusted performance across any interest rate regime.

Financial advisors can download a copy of "The 60/40 Problem: Examining the Traditional 60/40 Portfolio in an Uncertain Rate Environment" by clicking here. If you would like to further discuss the concepts of the paper, please reach out.