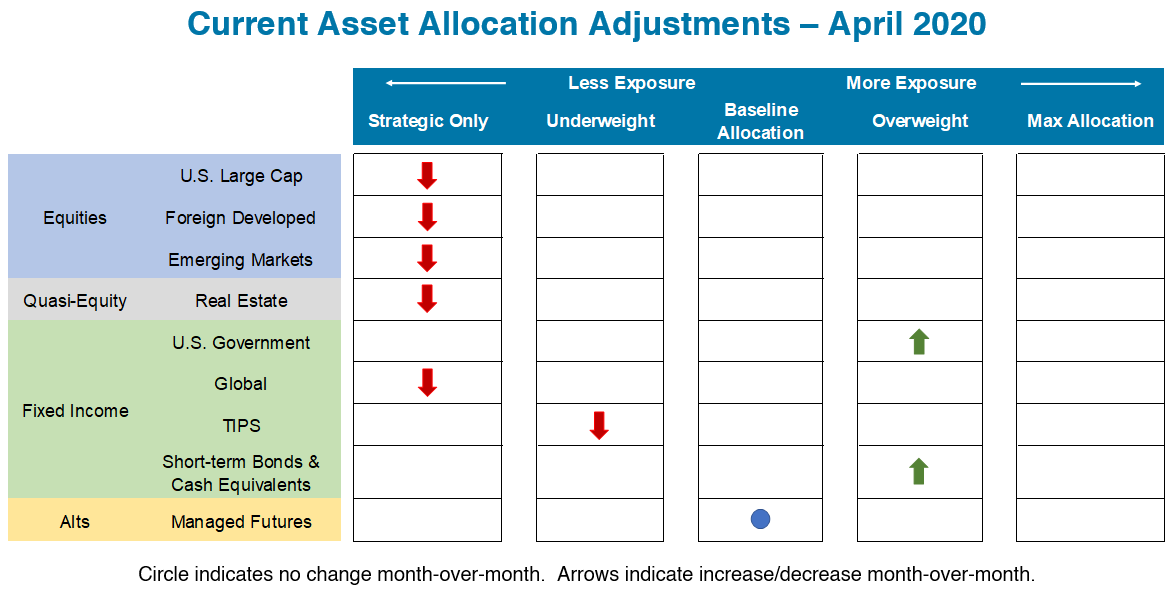

First, we sincerely hope this note finds everyone safe and healthy in your world. Blessings abound for our team and our families, and we are grateful to be here to serve our clients and friends. To paraphrase the line from Cool Hand Luke, we will not be accused of a ‘failure to communicate’! Every month, on the last trading day when we rebalance our portfolios, we send a note to our clients and partners with an update on changes in the model and the status of price trends based upon our rules and systems. This month, we want to share it with our full audience, because we believe it is insightful regarding the current environment, and because we are proud of our work. Please read on.

Tag: transparency

Topics: Behavioral Finance, Transparency, Systematic Investing

When I first joined the team here at Blueprint, there were several "Ah ha" moments that stood out. Coming in, I considered my role as National Sales Director to be leading the effort to broadcast the power of Blueprint’s sophisticated, yet simple story. As I reviewed our existing marketing materials, I noticed a chart comparing our Growth strategy (an 80/20 stock/bond model at its baseline) to a traditionally allocated Balanced portfolio.

Topics: Advisor Practice Management, Behavioral Finance, Transparency

The Impact on Advisors (Does Free = Free?)

A frequent topic in our writing is the changing landscape for advisors and investors in terms of the cost of doing business and the impact of technology. With so much rapid change taking place in the industry, there has not been a shortage of material. In fact, it was only a few years ago that things like trading commissions were a major consideration when developing investment strategies. What are now mainstream approaches, like passive investing, robo-advising, and low to no commissions, were once either obscure or did not exist. We are now simultaneously experiencing peak passive and a new low in the race to the bottom on fees.

Topics: Transparency, Systematic Investing

Like the networks in the summertime who replay their episodes to recycle good material, I thought a revisit of the much discussed and maligned DOL Fiduciary Rule was in order due to its recent vacating by the 5th Circuit Court in New Orleans. With or without the rule, it is time for the industry to step up!

Topics: Advisor Practice Management, Transparency

Back in the dark ages when I started my career in banking, the pace of work and communication was entirely different. Imagine a world with no mail other than what came with a stamp on it or in an interoffice envelope (who remembers those?). Your phone messages came on a pink slip of paper and you dictated your memos. You could actually choose to leave your work at the office. Of course, the biggest change today is that you literally carry your office around in your pocket or a backpack. (Briefcases are gone as well.)

Topics: Advisor Practice Management, Transparency