How many times have you stopped and considered the real meaning of words used every day? More importantly, how often do you challenge your own notion of that meaning by looking it up?

Recently I heard a friend and father I respect tell his son that discipline is more important than motivation. He said, “Motivation can come and go, but discipline will take you where you must go, even when you are not feeling very motivated.” It was compelling enough to me that I jotted his words down and started thinking about the meaning of those words – and also their implications.

Better Late Than Never

It would have been ideal to receive this advice a long time ago.

I have always considered myself a motivated individual, and I am not very satisfied unless I am doing something (constantly). Right now, I am watching the news and writing this blog on a Saturday morning. Yep, that might be called motivated. However, I had the idea for this blog last Tuesday. Although I was disciplined enough to write the idea down, I wasn’t motivated to write it until today. So perhaps one could argue that it takes both to accomplish our goals. Hard to debate either way.

The two words are often used interchangeably in the noun form. However, I think motivation is viewed by our culture as the more attractive word, probably because discipline in the verb form is what we all received when we were young and did not follow a rule. Think about that: We may have been motivated to drop an M-80 in a toilet bowl but were severely disciplined when the toilet had to be replaced (sharing for a friend).

The two words are often used interchangeably in the noun form. However, I think motivation is viewed by our culture as the more attractive word, probably because discipline in the verb form is what we all received when we were young and did not follow a rule. Think about that: We may have been motivated to drop an M-80 in a toilet bowl but were severely disciplined when the toilet had to be replaced (sharing for a friend).

There are literally thousands of instances every day when we follow the rules or guidelines to get things done, not always with a burst of motivation.

As simple examples, the discipline of a to do list should keep us on point during the day, even when we are not feeling particularly motivated. If we are disciplined enough to exercise even on days when we feel tired, the cumulative effect over time is significant.

This last point is where my friend’s advice collides with Blueprint Investment Partners' business.

THE IMPORTANCE OF DISCIPLINE ON INVESTING (BEHAVIORAL FINANCE)

We write a lot about human behavior and the impact of that behavior on our lives. We focus specifically on investment portfolios and the relationship between behavior and the achievement of our financial goals.

Often some of the most counterproductive motivations are instigated by market conditions that, despite being part of a normal market cycle, are irresistible emotionally. Who out there has had FOMO when the market is roaring higher and we feel we are missing out? Who has not acted on their fear when the news media is screaming, “The end is near!” after a few volatile down days or weeks in the market?

This is when discipline is more important than motivation, and why my friend’s advice to his son makes a real difference over time.

At Blueprint, discipline is what allows us to resist (negative) motivations and stay the course, adjusting with the systematic investing rules we have established and not due to emotion-driven reactions.

Much like exercise, the discipline to stay the course in investing has a noticeable cumulative effect over time.

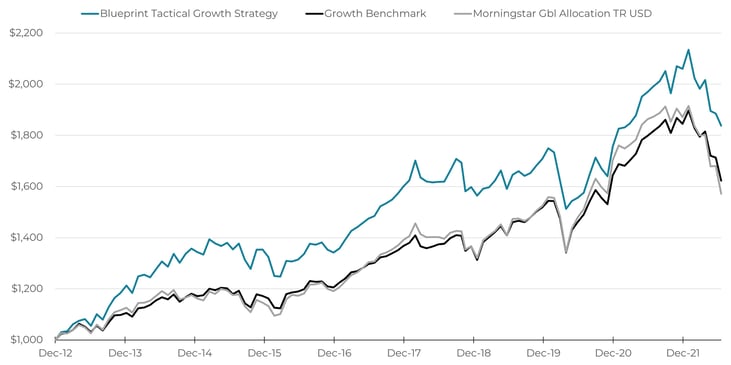

The Cumulative Effect of Systematic Investing Discipline (Growth of a $1,000 Investment)

Source: Morningstar and Blueprint Investment Partners, since inception of the Blueprint Tactical Growth Strategy (1/1/2013) to 6/30/2022. Performance results are presented in U.S. dollars and are net of annual sub-advisory fees of 0.50%. It is not possible to directly invest in an index.

Source: Morningstar and Blueprint Investment Partners, since inception of the Blueprint Tactical Growth Strategy (1/1/2013) to 6/30/2022. Performance results are presented in U.S. dollars and are net of annual sub-advisory fees of 0.50%. It is not possible to directly invest in an index.

The chart above illustrates the compounding potential of a global asset allocation portfolio that’s disciplined about applying the systematic investing rules of trend following (Blueprint Tactical Growth Strategy) versus a static allocation (Morningstar Glbl Allocation TR USD). As you can see, following the rules makes a difference, without any human intervention. Imagine trying to insert some human behavior in this mixture, which often results in buying high or selling low – not good – as studies by Dalbar consistently show. Raise your hand if this strikes close to home.

Motivation vs. Discipline

Our research has shown that from an investment perspective, discipline wins the day. Our systematic investment strategies follow strict rules and execute without hesitation or human motivation. We refer to this as behaviorally intelligent investing because if investors can have the emotional intelligence to avoid less rational behaviors, the results can improve dramatically over time.

The advice was sound: Motivation comes and goes, but discipline will allow us to stay the course.