Is Planning Alpha Greater than Investment Alpha?

How does that saying go? Something about how the more things change, the more they stay the same?

Within financial advisory practices, this sentiment rings abundantly true in the area of portfolio construction/management.

So much has changed in the past few years. For one, the pandemic altered how investors interact with their advisors. Potentially more importantly, due to the prolonged bull market and relative outperformance of passive strategies, advisors have increasingly focused their attention on generating alpha from tax and financial planning.

And yet, nothing has changed at all: this same up-up-up trajectory in stocks shields many advisors from having to face the critical decision on whether to outsource the investment function of their business.

We wrote about this topic back in 2019 after the release of a study on portfolio management, which was published by the financial services research and consulting firm Cerulli Associates.

At the time, Cerulli found only 7% of financial advisory practices were suited to do their own research and portfolio construction/management. Yet, 62% were in fact performing these functions for their clients.

Our takeaway then, as it is now, is this: just because you can manage assets, doesn’t mean you should.

What’s the ROI on Portfolio Management for a Financial Advisor?

Investment management requires continuous research and attention. Add in the rebalancing and managing of tax implications, and the result is that portfolio management requires plenty of mental energy and time. Most financial advisors we talk to don’t have an infinite supply of either of those precious resources.

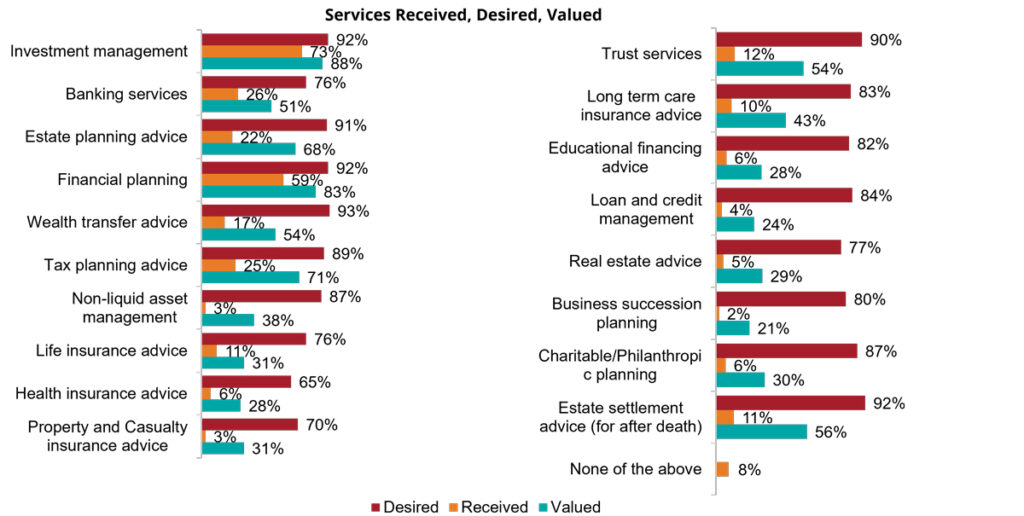

Given those constraints, advisors need to make decisions about where they can add the most value for their practice broadly and for clients specifically. The following chart reinforces this point by highlighting what investors value the most from their financial advisors.

Can you provide all these services independently? Maybe. Should you? It seems like a risky bet to me. The bet only works out if you have total confidence that clients will embrace a jack-of-all-trades-but-master-of-none approach, not seek alternative providers for some of these services, nor look for a new advisor who can offer everything under one umbrella by partnering with outsourced providers for some of the functions.

Clearly there are some significant gaps between what investors want and what they’re receiving. Advisors who can close these gaps will have an advantage. But, how do you do it?

- You can add more to your plate. Unless you’re superhuman, this usually only is sustainable for short sprints.

- You can grow a team of partners to offer new services beyond your current offering.

- You can offload some of what you current provide, freeing up your personal capacity to focus on services that add the most value for clients.

For advisors who gravitate toward the third option, investment management is a natural area to evaluate.

Humans Add Value, Robots Process Data

Partnering with an asset manager who can serve as portfolio manager doesn’t mean completely removing oneself from the equation, despite this being a common assumption. In fact, we think that’d be folly. Advisors are the humans (we want to emphasize HUMAN because we think you are the sweet spot between robo-advisors and dinosaurs) who are best positioned to help clients assess how much risk they are comfortable with, and then determine the suitable asset allocation. We almost never suggest an advisor offload the risk assessment and asset allocation components of financial planning because both are integral in establishing trust and building a lasting relationship with your client.

But, once the plan for the portfolio is established, advisors don’t usually need to be the day-to-day portfolio managers, especially given the constraints on time and technology resources.

A good partner can manage the core of your client assets for a competitive fee. For example, advisors who choose to outsource their investment management should expect the end results to include:

- Increased bandwidth to focus on serving your client and attracting new ones. By offloading portfolio management responsibilities, you’re able to focus on what you do best: managing relationships, building new ones, and generating financial planning and tax alpha. We believe top financial advisors recognize that these are the value-rich activities that improve client retention, create operational efficiencies, and often lead to referrals.

- Institutional quality investment management. While we cannot speak for all asset managers (nor do we care to), we can confidently say that a key benefit to outsourcing with Blueprint Investment Partners is gaining access to a high caliber asset manager. Our systematic investing process automatically adapts to market changes and any economic environment. It’s designed to limit downside losses during market drawdowns but still keep up with its relevant benchmark during bull markets. The goal is to smooth the ride for an advisor’s clients with an all-weather portfolio. Additionally, we provide ongoing research and communication around our strategies, constantly improve trading and operational efficiencies, and focus on minimizing both taxes and cost wherever possible – everything an advisor should expect from an institutional money manager.

- Attention to tax efficiency. We think the first thing a top-notch outsourced asset manager partner will do when they receive a new account is look at cost basis for each position, assuming it’s a taxable account. For Blueprint, we have a robust process for handling positions with low cost basis, and we customize our approach around those positions. Furthermore, our trend-following discipline is naturally tax-friendly because it sells losses quickly and holds winning positions indefinitely if the trend doesn’t change.

- Operational efficiency. Advisors we speak with often share that a significant amount of their time is dedicated to routine maintenance and operations. This precious time could be spent on a multitude of higher priority items. Plus, outsourcing shifts some of the liability for these important functions. A good outsourced partner can help with things like required minimum distributions, withdrawals, rebalancing, and reporting. This allows you to stay focused on your clients’ needs to deliver superior service, while generating significant relationship and planning alpha.

Rose-Colored Glasses Have Been Selling Like Hotcakes!

Let’s face it, two of the biggest reasons why so many financial advisors continue to handle their own portfolio management are also simple to explain:

- Changing the mindset that an advisor is the sole owner of investment management is hard! Some feel they need to justify their fees to clients and therefore think they should keep as much as possible in-house. Others have been stock picking their whole career, and it’s something they’re comfortable with and attached to. Another group is open to outsourcing but haven’t yet found the right partner.

- The 13-year bull market has done a good job of masking chinks in the armor. Even if most advisors aren’t well-suited to do their own research and portfolio management, it’s not like clients are complaining about their double-digit annual returns. When conditions change, we think some advisors will be caught flat-footed and unprepared to provide a smooth ride for their clients, manage through volatility, and deal with the tax consequences. We worry most about clients served by advisors who have leaned into passive-only strategies over the past 10 years.

If you’re an advisor who’s considering outsourcing – or considering changing your partner – we would love to earn a spot on your short list.

Jon Robinson

Let's Talk

If you’re interested in a conversation about outsourcing