If you search deep in the nooks and crannies of your memory, you probably can recall one specific fashion choice you made in your younger days that you now look back on with absolute shame. You may have destroyed the pictures – I know I did, and thank goodness this was before the digital age! – but the memory is still there. Whether it be of a mullet, popped collars, parachutes pants, dramatic shoulder pads, or a rat tail, it’s in there, suppressed and collecting dust.

We made these choices because we thought it made us look cool, all our friends were doing it, or out of rebellion. We probably had friends or family members try to talk us out of it, or at least help us find a new path eventually.

Similarly, now more than ever, investors need financial advisors who can talk them out of the investing equivalent of baggy parachute pants.

That point smacked me in the face when I ran across a survey of financial advisors on the topic of behavioral finance. BeFi Barometer 2021 is the third year of data from a collaboration among Schwab Asset Management, Cerulli Associates, and the Investments & Wealth Institute.

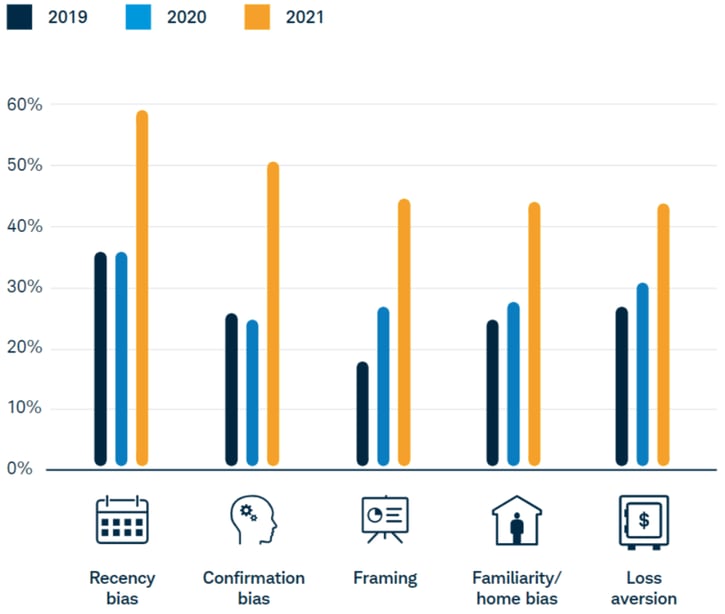

The illustration below shows the dramatic increase in advisors’ reporting of behavioral biases among their clients.

Surge in Investor Biases

Source: schwabassetmanagement.com/content/befi-barometer-2021

While 2019 and 2020 were relatively similar, the change in 2021 is pronounced and influenced heavily by various events that transpired since the early weeks of the COVID-19 pandemic, such as:

- Market volatility

- 2020 election tumultuousness

- General unease about long-term financial security

- Explosion of meme stocks

In short, in “normal” times, the natural human biases we all have are easier to keep at bay. But, in times of uncertainty, those anxieties come to the forefront and investors need advisors who will help them resist the urge to make financial decisions they may later regret. These distractions from long-term financial goals come in many forms:

- abandoning risk-management strategies during prolonged bull markets,

- chasing performance,

- selling out of all equities after large drawdowns,

- paying too much for portfolio “insurance” due to a recent equity blip, and

- numerous other investing equivalents of baggy parachute pants.

Less Anxious Clients = More Successful Financial Advisors

The benefits of mitigating biases for investors are obvious; staying anchored to the plan gives them the best chances of meeting their long-term goals. Yet, at Blueprint, we think the mutually beneficial impact on advisors’ practices often is overlooked.

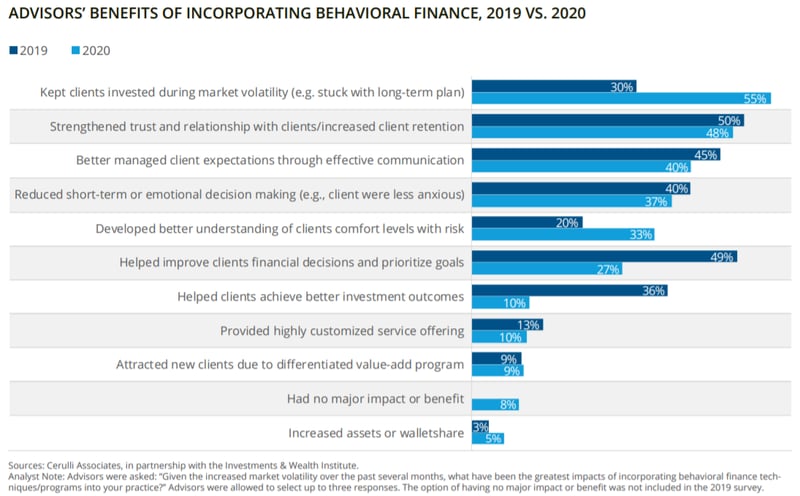

While BeFi Barometer 2021 notes five top benefits of incorporating behavioral finance into an advisory practice, BeFi Barometer 2020 went a step further by sharing specific results reported by advisors.

Source: info.cerulli.com/rs/960-BBE-213/images/SchwabBeFi%20Whitepaper%20-%20Evolving%20Role%20of%20Behavioral%20Finance%202020.pdf

Source: info.cerulli.com/rs/960-BBE-213/images/SchwabBeFi%20Whitepaper%20-%20Evolving%20Role%20of%20Behavioral%20Finance%202020.pdf

As I see it, the unifying themes in the data above are that incorporating behavioral finance increases client confidence in and satisfaction with their advisor, as well as reduces attrition for the practice. Those points shouldn’t be understated, especially if you’re an advisor who, you know, wants to make a living.

How Advisors Can Help Would-Be-Mullet-Wearers Put Down the Scissors

The WHY behind mitigating behavioral biases isn’t as hard of a case to make as the HOW. We only need to think back to the times someone tried to talk us out of our personal past fashion fails as evidence.

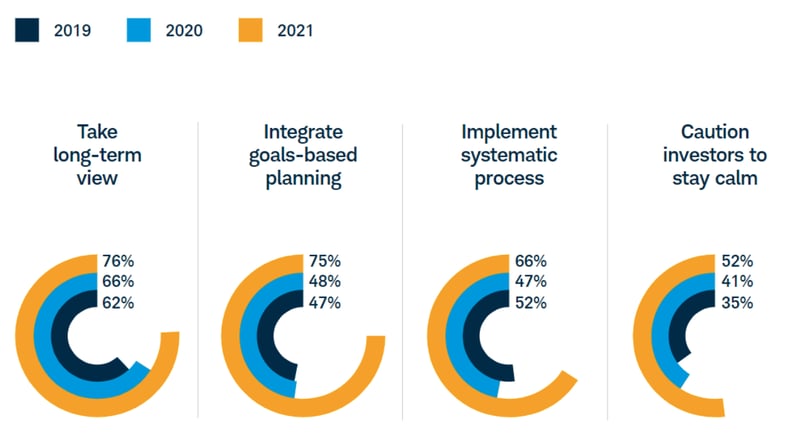

BeFi Barometer 2021 highlights several techniques currently used by advisors to counteract behavioral biases, especially the four shown below.

Behavioral Finance Techniques Advisors Report Are Effective

Source: schwabassetmanagement.com/content/befi-barometer-2021

What catches my eye is that only one of the four – implementing systematic processes – intersects with portfolio construction. This is specifically called out in the 2021 report: “Since the launch of the BeFi Barometer in 2019, advisors have consistently indicated that they are more likely to use behavioral finance techniques in their client communications than within their portfolio construction process itself.”

At Blueprint, we think anything that improves the behavioral friendliness of an advisor’s practice is positive, period. But, not considering the connection between portfolio construction and behavioral finance will limit an advisor’s success and potentially lower the probability of the client meeting their goal.

A key consideration should be how an advisor’s client is going to FEEL about their portfolio’s behavior in both up and down markets. Practically speaking, the probability of a client abandoning their financial plan increases every time an advisor must defend a position and explain why it’s worth holding, or anytime a portfolio is constructed in a way that runs counter to what the client can “stomach.”

We built Blueprint on the philosophy of systematic investing for this very reason, because it can remove human biases from the equation by providing a repeatable process that answers questions about what to buy and sell, when to do so, and how much to transact. This helps clients stay anchored to their goals by empowering them to ride through emotionally charged environments. Plus, the track record for trend following (our preferred flavor of systematic investing) is compelling when applied to a traditional 60/40 portfolio, utilized as a downside protection strategy, or used as an alternative to liquid alts.

The Fleeting Nature of Singularly Focused Advisors & Popped Collars

Stepping back to look at the big picture, I think the biggest takeaway from BeFi Barometer 2021 is the reminder that investors seek advisors for more than simply managing their portfolios. (As an aside, there’s actually a growing number of advisory clients who seek advisors for financial planning only and NOT for investment management at all. We think that’s a problem and discussed it in another blog.)

Investors need advisors who can offer a total package of robust services. This includes creating a dynamic and comprehensive financial plan, optimizing tax efficiencies and savings, and recommending sound investment strategies – all while managing the internal concerns that gnaw at a client during times of change and uncertainty.

At Blueprint, we’re passionate about behavioral finance because we believe the best way to manage clients’ internal anxieties is with an investment strategy that removes human emotion by pre-determining which assets to buy and sell, when to enter and exit, and how much to transact. For example, our systematic investing strategies essentially put risk management and asset allocation on autopilot.

Strategies like these permit advisors to confidently communicate with their clients no matter what the market throws their way because a plan for adapting is already baked into the portfolio. With this knowledge in hand, advisors can turn their full attention to building deeper client relationships and generating planning alpha.

If you’d like to discuss how to add or improve the behavioral friendliness of your practice and portfolios, please reach out.