Word Count - 679 Words

Reading Time - ~3.5 minutes

Last week, Blueprint hosted a webinar with our friend Jay Mooreland, author of The Emotional Investor. The event motivated me to reread his book, which I highly recommend. It also reminded me of the investment industry’s annual prediction cycle about what to expect for the coming year and how the market will behave based upon those predictions. Two points here: one, analysts and economists have no idea what is going to happen and two, what happens does not matter to the disciplined investor. Read on!

Know What You Don’t Know

“What counts for most people in investing is not how much they know but rather

how realistically they define what they don’t know.” -Warren Buffett

We are at a point in the investing cycle where a good number of ‘investors’ are having success trading in and out of stocks, because momentum is in their favor. The volume of cocktail conversations about how much fun trading is tells me the end may be near. For those that can make some money, congratulations.

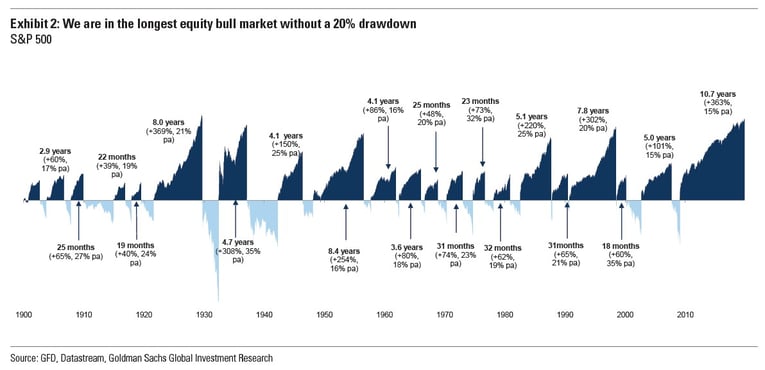

But to those that are in the market for the first time and have never truly experienced a market correction, I say look out. We are in the longest bull market run in HISTORY without a significant market correction. Everyone is a genius during periods like this.

But all the thoughtful reading and consideration they may have utilized making the investments flies out the door when volatility rears its ugly head. If you do not know how it feels to watch the market plummet without reason, then you also don’t know how you will react. Unfortunately, the reaction is quite predictable, and the decisions that follow may very well be irrational.

Use Your Rational Brain

There is really no such thing as a rational brain, but the concept applies. As Jay documents very well, human beings react with emotion to periods of volatility or unpredictability, because we use the portion of our brain that is more emotional and reactive. Many investors constantly watch their portfolio and attempt to rationalize what is happening to the account value relative to the market news (which they are also watching). This feeds the reactive brain and often results in making decisions on an irrational basis.

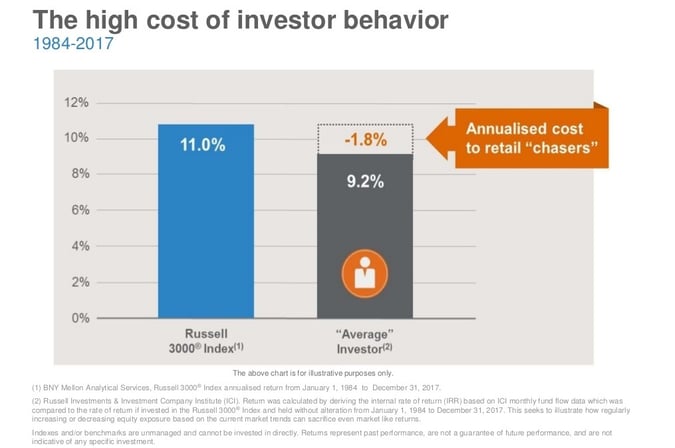

There is significant research regarding the influence of investor behavior on long term investment returns, and the data is not good. See below research from Russell Investments which reveals a 2% annualized variance.

That is a huge variance over a retirement savings period of 20+ years. The message – don’t allow near term events and news impact long-term goals and objectives.

Have a Plan

At this point you might be thinking that if it was as easy as just ignoring the news, everyone would do it. We have written much about the value of a financial advisor and the power of following a well-designed financial plan. The real benefit of having an advisor and a plan is the fact that a good advisor will also serve as your financial behavioral coach when the inevitable market volatility makes you question your portfolio strategy. If you do not have a plan, you are planning to fail (hat tip to Ben Franklin).

Blueprint designs its investment strategies with the advisor and the investor in mind, as our systems are designed to adjust the portfolios without any human input. Said another way, we have designed emotionally intelligent strategies that will systematically manage risk based on rules written many years ago. Rules that were written without emotion and with great thought and planning.

We believe the combination of a good advisor, a solid plan, and emotionally intelligent investment strategies is the perfect antidote to an unpredictable market and the potential for irrational behavior.

For more thoughts on ways to evolve your investment approach and reduce the impact of human behavior on investment decisions visit www.blueprintip.com

Recommended follow-up:

Listen to – Blueprint Jay Mooreland Webinar Replay

Read – The Emotional Investor by Jay Mooreland, MS, CFP®