You may have seen or heard about the, “how it started...how it’s going,” trend that’s been going around the internet lately.

The concept is to show the passage of time in two images, often to highlight accomplishments and sometimes purely for comedic value — you’ll find examples of each in this post.

In this blog, which is the last of a three-part series on ESG investing, we’re looking at the, “how it's going,” particularly as it relates to adoption and implementation.

.@KingJames made his NBA debut 17 years ago today:

— SportsCenter (@SportsCenter) October 29, 2020

How it started How it's going pic.twitter.com/upkWu42iEK

How it started. How it ended. pic.twitter.com/41IH3MtNds

— The Office Memes (@OfficeMemes_) October 9, 2020

ESG ADOPTION & IMPLEMENTATION

This three-part series has been exploring concepts around ESG investing:

- Early obstacles and an entry point

- Drivers and barriers

- Adoption and implementation (the focus of this post)

Our framework takes cues from a whitepaper published by the CFA Institute, “ESG Integration in the Americas: Markets, Practices, and Data.” Their main findings (in bold below) are a suitable framework for us to opine on the topic, though we have rearranged the findings to create a more sensible narrative for these purposes.

QUESTION THE PRODUCT, NOT THE CONCEPT

Many workshop participants were concerned that ESG mutual funds and ETFs offered to investors may be driven by marketing decisions and may not be true ESG investment products. Buyers should beware of products that claim to be ESG investment products.

We’re not here to say that all ESG products are good. Because they’re not. In fact, this was one of the driving forces behind Blueprint launching its own ESG strategy; we were frustrated with all the marketing-first options we saw in the marketplace.

Justifiably, many ESG products will fail to gain traction.

Still, getting a product to market is often a necessary collaboration method between fund sponsors and investors. In this vein, consider Silicon Valley’s preferred software development framework, the agile method, which is based on a manifesto with the following ideals:

- Individuals and interactions over processes and tools

- Working software over comprehensive documentation

- Customer collaboration over contract negotiation

- Responding to change over following a plan

An overriding theme of this methodology is continuous improvement rather than a finalized output. This is relevant when thinking about the early iterations of ESG products and the need to respond to changes in an evolving space. And while it is true that marketing campaigns are often quicker to market than a fully refined product, this is no reason to be skeptical of ESG’s broader trajectory.

If you, like us, believe that optimal management of resources, social equity, and ethical corporate administration can significantly benefit human productivity and profits across the board, then the trend is your friend.

Longer-term, we are aligned with the CFA’s Institute’s belief that, “The term ‘ESG investing’ will fade away as ESG analysis becomes more accepted as simply a part of investment analysis.”

PISTONS POPPIN’ / AIN’T NO STOPPING NOW!

Investors acknowledge that ESG data have come a long way, but advances in quality and comparability of data still have a long way to go.

With a nod to the late, great Eddie Van Halen, consider the pace at which the ESG movement is hurdling forward.

It took time for the CFA Institute to gather the underlying data for the report we have been citing, and then to write and publish the document, which was released in 2018. But, it’s 2020. There are already aspects of the report that are vastly different from two years ago, including this one.

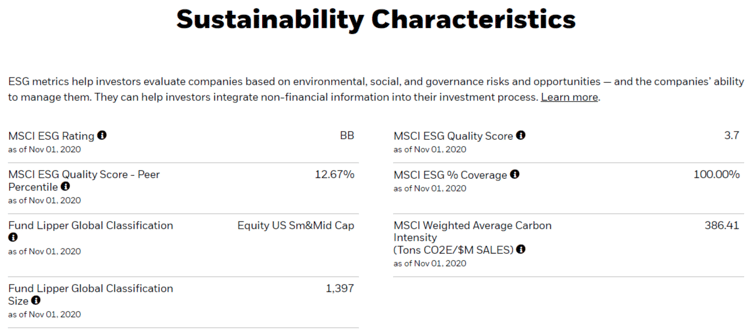

As an example, there seems to be a critical mass of centralization around the ESG data supplied by MSCI. BlackRock, which is viewed as a leader in ESG thanks to the initiative of CEO Larry Fink, includes “Sustainability Characteristics” for many of its funds, which are fueled by data from MSCI:

Source: https://www.ishares.com/us/products/307330/ishares-focused-value-factor-etf/

MSCI’s data is also a critical input for the Blueprint ESG Strategy. We use MSCI’s ESG methodology as the starting point for constructing our own portfolio.

The point is: If data quality and comparability issues haven’t already been solved for, it seems imminent.

EMBEDDEDNESS ON THE HORIZON

Portfolio managers and analysts are more frequently integrating ESG into the investment process, but rarely adjusting their models based on ESG data.

In some respects, we are reminded of the nascent stages of fintech, where the renegade insurgents promised to disrupt financial services as we knew it. Now, you’re seeing incumbents buying up the upstarts in order to implement their tech innovations.

We expect something similar to happen with ESG, where it goes from a separate analysis to something more fully embedded within the investment process.

What could provide the final push? If it plays out like the fintech revolution, it may take a healthy dose of “fear of missing out” — like how traditional financial services players saw their peers reaping the benefits of being more tech-forward and decided they also needed to get in on the action. Or, it may take portfolio managers seeing that companies with attractive E, S, and G factors are being rewarded with higher valuations and/or profits, which may prompt managers to adjust their models to increase the prevalence of them uncovering companies with positive ESG attributes.

EQUITY BEATS FIXED INCOME IN THE RACE TO ESG INTEGRATION

ESG integration is farther along in the equity world than in fixed income.

Ah, fixed income: a publicly traded asset class that still does not trade on an electronic exchange and whose major indices are weighted to favor those companies that are most heavily indebted.

While I digress somewhat, it’s in this vein that it’s really no surprise that the equity markets have been quicker to integrate ESG than fixed income. However, with broader availability of ESG data, we don’t think that any smart analyst should have trouble incorporating this into a fundamental credit analysis.

While we think it’ll continue to be the laggard in ESG adoption, we think that in time the trend will find its way into this asset class as well.

FOR REAL NOW: ‘HOW IT STARTED...HOW IT’S GOING”

If you’ve read this far…

First, thank you!

Second, you’ve probably already picked up on what we think about “how it’s going” for ESG investing. But, as ardent believers in developing systems and rules (and then sticking to them), we feel compelled to stay true to the, “how it started...how it’s going” trend. Here’s how we’d sum it up:

What do you think? How’d we do? We welcome your thoughts and questions by email.