Death of a Wholesaler: The Future of Asset Management Marketing

I’ll start off by saying that prior to joining Blueprint Investment Partners, I was nicknamed “MC Spammer.”

Yeah, that’s right.

It was funny…at first.

In fact, I joined Blueprint Investment Partners because I knew there had to be a different way of engaging and partnering with financial advisors: no scripts, no “hard close,” just creating value and permitting interested advisors to reach out to us. But, for this approach to work, buy-in and patience is required – everyone on the team must be onboard.

The Writing Was On the Wall Prior to COVID-19

Whole-sal-er (noun) – a person or company that sells goods in large quantities at low prices, typically to retailers.

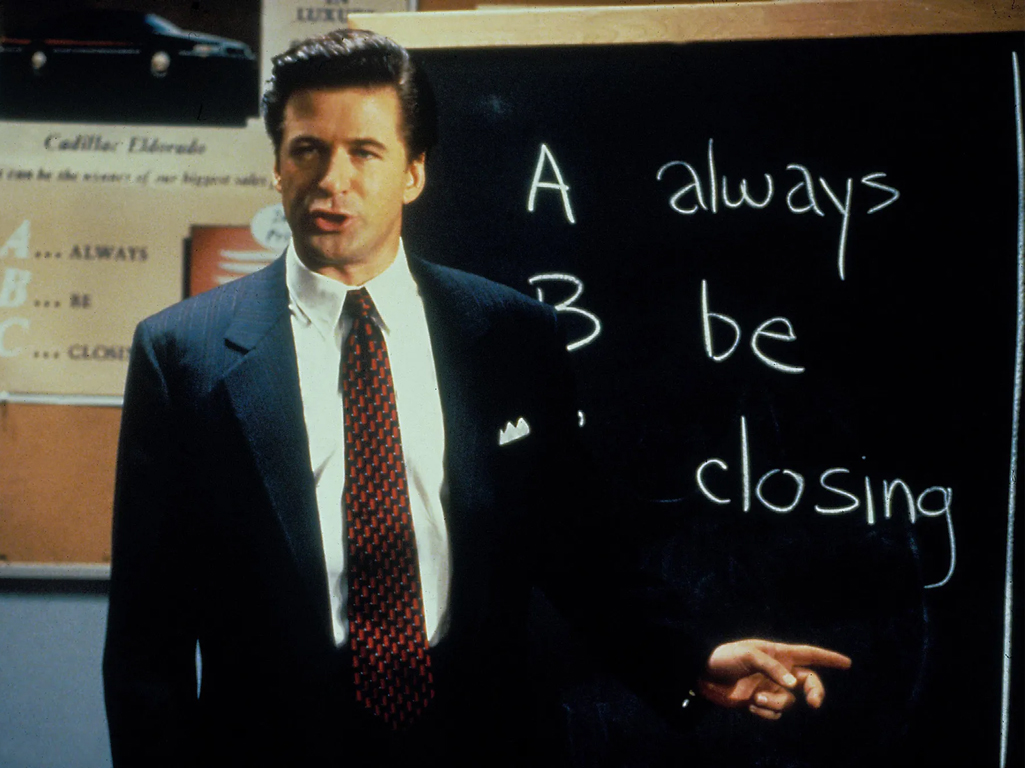

Prior to coronavirus, a (large) portion of financial wholesaling was stuck in the 1990s, with steak dinners, phone scripts, and “hard closes.” At the same time, asset management itself had been majorly disrupted by the advent of model portfolios, free trading, robo-advisors, and no-fee ETFs. The dichotomy just did not make sense.

The rules of the pandemic forced some very new and difficult conditions on wholesalers and their traditional sales process. Besides accelerating the migration away from opaque wholesaler-friendly products to transparent investor-friendly instruments, the pandemic has also limited mobility, keeping wholesalers indoors and removing face-to-face interactions.

One of the likely reasons for the difficulty in wholesaling to financial advisors is that investment products have become so commoditized. There is a multitude of similar products and platforms vying for the same, increasingly less engaged audience. Plus, with the equity markets (prior to COVID-19) virtually going straight up since the 2008 Financial Crisis, many advisors have wisely focused less on adding value through investment management and more on financial planning and client relationships. Alpha now comes from the human and service side of the practice, which we recently highlighted in “The Elite Advisor Playbook.”

‘Hey Sales Manager, 1985 Called & They Want Their Approach Back’

At some point. sales leaders for asset management firms who grew up in the industry through the 1980s, 1990s, and early 2000s will retire. And they’ll take their phone scripts and hard sales pitches with them.

That’s the easy part. A no-brainer.

Even prior to joining Blueprint Investment Partners, one question I pondered was, “How do you actually get a value-add message through an endless sea of product pitches?” Of course, everyone thinks they have the value story, the diamond in the rough. The reality? There isn’t a “pitch” that a seasoned financial advisor has not already heard. That is why most asset manager emails get “filed under G” (for garbage).

Enter Modern Asset Manager Marketing

Blueprint Investment Partners believes that the asset manager of tomorrow will need to do more than just build strategies. To survive in an industry where 75% of asset flows go to one of five companies, we will need to truly be different and add value for financial advisors and their clients. This is our primary objective.

At Blueprint Investment Partners, we’re committed to

- Communication

- Transparency

- Education

But what makes us different is that our actions truly speak louder than words, which is why each month we publish exactly what is happening in our portfolios and why. Next, we challenge the status quo by objectively questioning beliefs that so many investors hold sacred, like that the “best 10 days rule” is a MYTH.

Lastly, there is a difference between marketing through thought leadership and sales. I think Blueprint Investment Partners is unique because we help many independent advisors stay connected with their clients. Client communication is an area where many advisors fall short, and Blueprint Investment Partners stands in the gap with content. Partnering with advisors to provide blogs, white papers, and video content is one way we accomplish the objective of marketing by adding value, rather than selling the old-fashioned way.

Our Promise to Financial Advisors

What attracted me to Blueprint Investment Partners is that we challenge the investing status quo, which is not easy to do. On the other hand, being static is not an option. So, when the conflicts, the monthly commissions, and the sales goals are removed, we can truly focus on what matters most: educating and providing value.

We ask that if you find something of value from Blueprint Investment Partners, allow us to share our full value proposition (no strings attached – we promise). And if you still prefer to avoid interaction with a “sales” person, please ask about a video/recorded webinar from our library, and we can go from there. It’s your call. We have made the advisor the hero in this story, not ourselves. And we won’t have it any other way.

Mike Carlone

Let's Talk

If you have any thoughts or feedback you’re willing to share