As parents (myself included) apprehensively sent their kids back into the classroom for another pandemic-influenced school year, it put me in the mood to chip away at my own reading list, a collection of research papers that had accumulated in the “to read” folder on my desktop.

Now, before you condemn me to the nerd-set, I’m only going to cover one in this blog, and specifically one that covers a topic that’s relevant for advisors and their clients: how to best protect against inflation.

If at the end you still feel the nerd label is appropriate, then fine. After all, somebody has to read this stuff! (In fact, we invite readers to send us studies they find interesting or have questions about. We’re always happy to discuss.)

The Best Strategies for Inflation

With inflation taking up such a significant portion of the news cycle lately (and our wallets), frequency bias kicks in, causing the eye to more easily pick up on the topic. It’s like when you’re shopping for a specific car and begin noticing similar vehicles on the road.

With inflation taking up such a significant portion of the news cycle lately (and our wallets), frequency bias kicks in, causing the eye to more easily pick up on the topic. It’s like when you’re shopping for a specific car and begin noticing similar vehicles on the road.

A good example of this phenomenon in financial markets is the May 2021 paper by the Man Institute entitled, “The Best Strategies for Inflationary Times.” The fact that this captures the current economic and asset management zeitgeist probably isn’t lost on many.

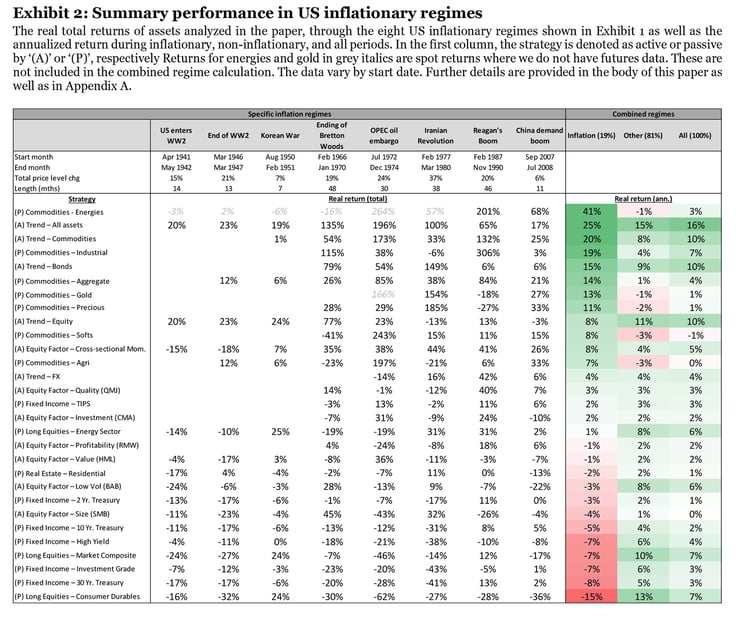

The paper stems from the notion that many investors are ill-equipped to handle inflation risk, given their limited experience with such environments after 30+ years of low or no inflation.

There are a few big takeaways from the paper, and the two that caught my eye were:

- Neither equities nor bonds perform well in real terms during modern inflationary regimes.

- “Trend following provides the most reliable protection during important inflation shocks.” (Here’s where the frequency bias was kicking in for me, considering Blueprint lives and breathes trend following.)

These findings combine to make a strong case for a dynamic or tactical approach to asset allocation. Specifically, applying trend following to a diverse basket of instruments that can benefit from inflation is the most reliable way to hedge against price shocks.

As seen below, the authors find that trend-based approaches were three of the top five and four of the top nine strategies for hedging inflation. Furthermore, the trend-based strategies also performed positively in non-inflationary times, while the non-trend-based approaches that appeared in the top 10 only performed mediocrely.

Source: “The Best Strategies for Inflationary Times,” Man Institute, man.com/maninstitute/best-strategies-for-inflationary-times

Source: “The Best Strategies for Inflationary Times,” Man Institute, man.com/maninstitute/best-strategies-for-inflationary-times

Click to enlarge

Commodities as an Inflation Hedge

I also want to highlight the authors’ findings around the distribution of commodity returns during inflationary environments.

While commodities generally performed well in these periods, they tended to be mediocre in times of non-inflation. Moreover, even when they did perform relatively well as a group of assets, there was noticeable divergence between individual instruments.

Thus, even if advisors adjust portfolios to hedge against inflation using commodities, it’s difficult to predict which individual instrument presents the best opportunity. Of course, a diversified basket can be utilized, but it comes with the cost of including underperformers that could ultimately undermine the purpose.

Learning From My Kids: The Power of Being Adaptive

If COVID has reminded us of anything, it is the importance of being adaptive. This has been evident in the education of our kids. I have been pleasantly surprised by my kids’ ability to go with the flow, whether it was wearing masks, social distancing, or remote learning. They have adapted and continued having fun, thankfully.

That’s the kind of adaptability Blueprint thinks should also be applied to managing advisors’ portfolios. Our response is to have processes that account for the risk of inflation AND bear markets, but also for growth. That’s what being adaptive is all about – having the knowledge and processes in place, even if they are not actively engaged. The potential cost of this approach is never being the top performer in any one environment, but if you excel in one environment only to go extinct in another, then the temporary success is for naught.

Though inflation has been mostly dormant for three-plus decades, that doesn’t mean we no longer have be ready for it or take it into account. Rather, it is like the risk of major market selloffs…ever present but not always actively occurring.

If you’d like to discuss the findings from, “The Best Strategies for Inflationary Times,” or how trend following may be able to help you and your clients achieve your long-term goals, please reach out. We’re always happy to connect.