A few weeks ago, I attended a family office conference on the West Coast that, as in the past, was comprised of a crowd of industry experts (writer excluded of course), including family office advisors, executives, and top minds from all corners of the investment universe. Being a lifelong member of the East Coast clan, it is always refreshing to have the mix of more traditional thinkers with those far less constrained minds of California.

As you can imagine, the topic of asset prices and market values was constantly present and hotly debated. The distressed debt manager was predicting bad weather, while acknowledging he makes most of his money when it is raining. The value managers were constantly assuring us all that while the traditional measures of the market, the cap weighted indexes, were indeed frothy, there are always bargains to be had if you know what you are doing. The macro team expressed strong belief in identifying fundamentals that were out of sync with values and touted expertise in exploiting those distortions – both long and short. And finally, there was the smart beta manager, who gleefully announced that her strategy could utilize algorithms to score stocks based on value factors and dynamically avoid a large portion of potential downside volatility. Regardless, the notion of valuation is an incredibly subjective concept in an increasingly complex, if not objective, investment world.

Does price always equal value?

Well, no, because if it did the value managers referenced above would never find any distortions through which to create return when the price converges with their perceived value. A practical example always works, and nowhere is this distortion more evident than with airfares. As I sit on a plane right now I am confident that no one on my row paid the same price and all of us have a different view of value, yet we all received the same utility -- and we all value our ticket similarly. Price frequently gets disconnected with value, based on a myriad of factors.

So how does all this tie back to my question

– do behavior bubbles exist?

I did not invent this expression, nor for that matter anything original in the genre of behavioral economics, but I am a huge fan of and have read a great deal on the subject. A while back I read The Undoing Project by Michael Lewis, which reflects on the research of and the interesting relationship between Daniel Kahneman and Amos Tversky – and I was hooked. When Richard Thaler was awarded the Nobel Memorial Prize in Economic Sciences last month, I found myself reflecting on some of his work, and why human behavior seems to repeat itself – over and over. After being awarded the Nobel Prize, Thaler was quoted in The Daily Telegraph as saying that his most important contribution to economics "was the recognition that economic agents are human, and that economic models have to incorporate that." While there are other famous laureates that debate some of his theories, one cannot debate the fact that human emotions exacerbate trends on the stock market – in both directions. Optimism and pessimism are hard at work when humans try to connect the dots between value and price.

Almost always present in market participant behavior are the very human biases that lead to what is often called rational herding. The economists noted above, and many others, have studied and written about the cognitive bias that leads human beings to be greatly influenced by the behavior of others. While not conclusive and certainly not a clear causal relationship, there is strong correlation between herd behavior and market peaks (and troughs). Look up Bitcoin or any popular ETF today and witness the effects of human behavior on the price of these instruments as the crowd has entered the markets with ever-increasing fervor. You tell me – is this the mark of a behavior bubble? (HT Jesse Felder)

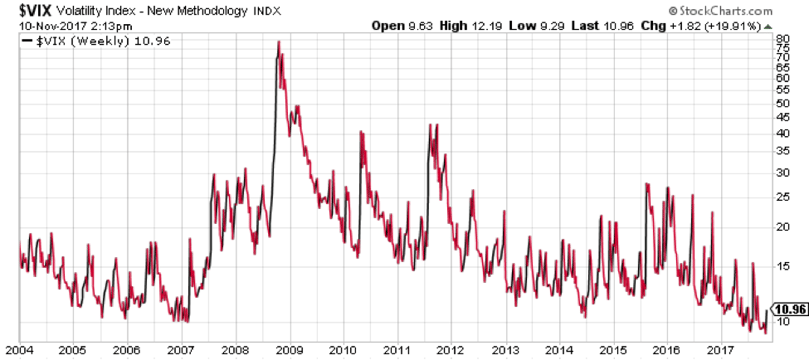

In an article by Jared Dillian early last summer entitled The Everything Bubble, Dillian made an excellent case that we are in the bubble zone, and it has gotten precipitously more bubble-icious since! In September he followed up with The Everything Bubble is Ready to Pop, boldly calling a top. The most interesting aspect of this article was the infographic highlighting components of the market relative to history. Clearly there is a case to be made that a drawdown is near, and the value of portfolio risk management is a premium at the exact time market participants are most complacent. Whitney Tilson shut down his hedge fund Kase Capital citing what, complacency? Arguably we need allocations to hedge funds right now more than ever. Named for the famous economist Hyman Minsky, is a ‘Minsky Moment’ just ahead? He famously asserted that ‘long periods of stability sow the seeds of instability.' And if you believe in the VIX as a fear gauge, then there has been an almost ten-year downtrend in fear. Witness the last year alone below!

While I cannot say there is only one way to avoid the inevitable consequences of riding the herd wave too long, I am convinced that a large part of the solution is taking the human (and the consequent human behavior) out of the equation with a disciplined and systematic allocation of capital based on price in all market environments. Over the last few years, I have become a fan of the efficacy of quantitative methods based upon momentum and trendfollowing to provide confidence to the investor at just the time his or her own behavior might cause a catastrophic decision. I am not calling a top, or a bottom for that matter, just suggesting you take a moment to recall the feeling you had looking at your portfolio in December 2008. Were you rational at that point?

I believe behavior bubbles do exist, and to expect that a strategy based purely on human reason will help you avoid them is simply not logical.

For more thoughts on ways to evolve your investment approach and reduce the impact of human behavior on investment decisions visit www.blueprintip.com

Recommended reading:

Thinking Fast and Slow, By Daniel Kahneman

The Undoing Project, by Michael Lewis

Nudge, by Richard H. Thaler and Cass Sunstein

Predictably Irrational, by Dan Ariely

Link Citations (In Order):

https://en.wikipedia.org/wiki/Smart_beta

https://en.wikipedia.org/wiki/Rational_herding

Felder, Jesse, Twitter, https://twitter.com/jessefelder/status/925065584622166017, October 30, 2017

Dillian, Jared, "The Everything Bubble", Mauldin Economics, http://www.mauldineconomics.com/the-10th-man/the-everything-bubble, June 22, 2017

Dillian, Jared, "The Everything Bubble is Ready to Pop", Business Insider, http://www.businessinsider.com/infographic-shows-how-close-we-could-be-to-an-economic-bubble-collapse-2017-9, September 20, 2017

Blueprint Investment Partners is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. For more information please visit adviserinfo.sec.gov and search for our firm name.

Information obtained from third-party sources is believed to be reliable though its accuracy is not guaranteed.

Information contained on third party websites that Blueprint may link to are not reviewed in their entirety for accuracy and Blueprint assumes no liability for the information contained on these websites.

PLEASE NOTE: This newsletter represents opinions of Blueprint Investment Partners, LLC and is subject to change from time to time. Any references to future events may not transpire as forecasted. It does not constitute a recommendation to purchase or sell any particular security or investment strategy. This material is being provided for informational purposes only. Blueprint Investment Partners reserves the right at any time and without notice to change, amend, or cease publication of the information. The information contained herein includes information that has been obtained from third party sources and is reliable to the best of our knowledge. It is made available on an "as-is" basis without warranty. Past performance is not indicative of future results.