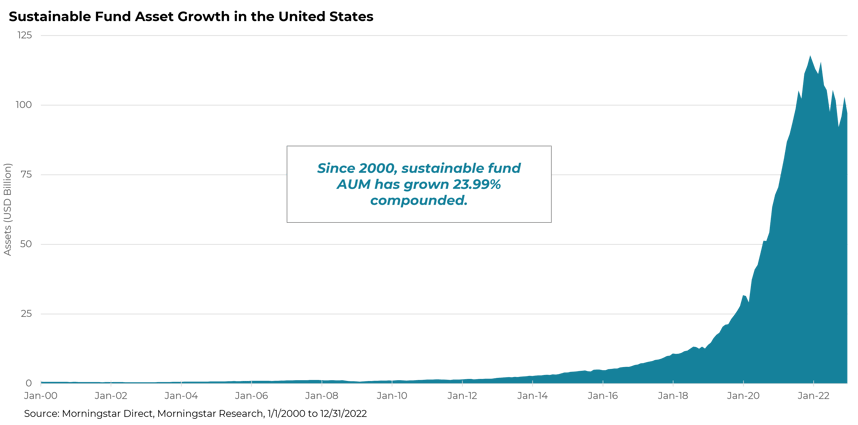

U.S. Investors Have Moved Billions into ESG Vehicles

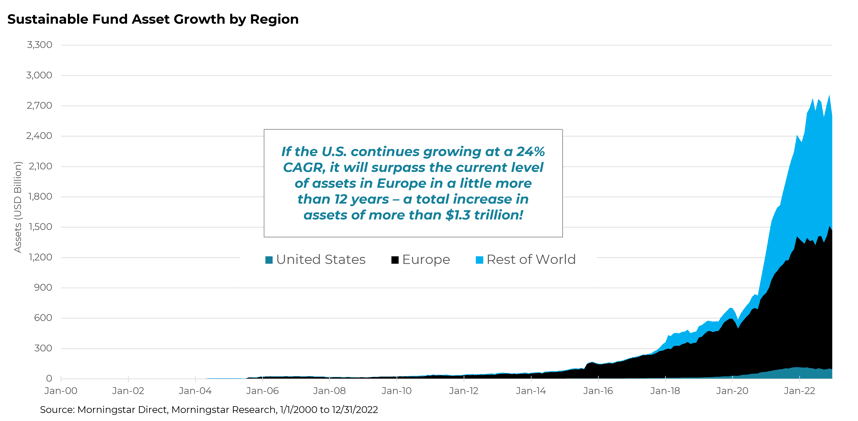

Yet, the U.S. Remains an 'Emerging Market' for ESG Investing

When your clients ask, will you be prepared for the ESG conversation?

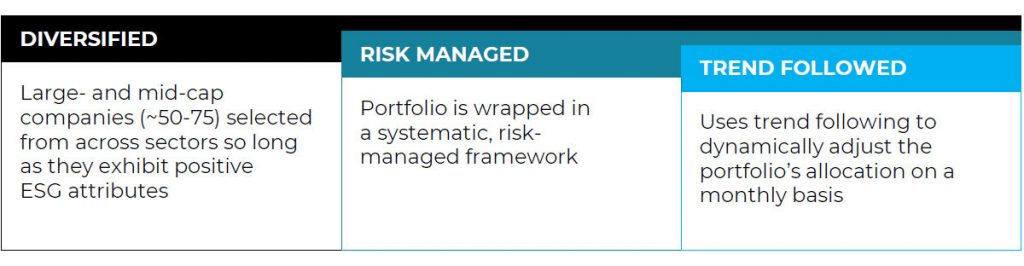

ESG With a Rules-Based Approach

Overview

Download Factsheet

Please reach out if you’d like to learn more about how an ESG strategy can empower you to align your clients values with their investing goals, please reach out.

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation.

Information obtained from third-party sources is believed to be reliable though its accuracy is not guaranteed.

Information contained on third party websites that Blueprint may link to are not reviewed in their entirety for accuracy and Blueprint assumes no liability for the information contained on these websites.