Download HANDOUT:

BLUEPRINT'S PERIODIC TABLE

download the handout

Overview

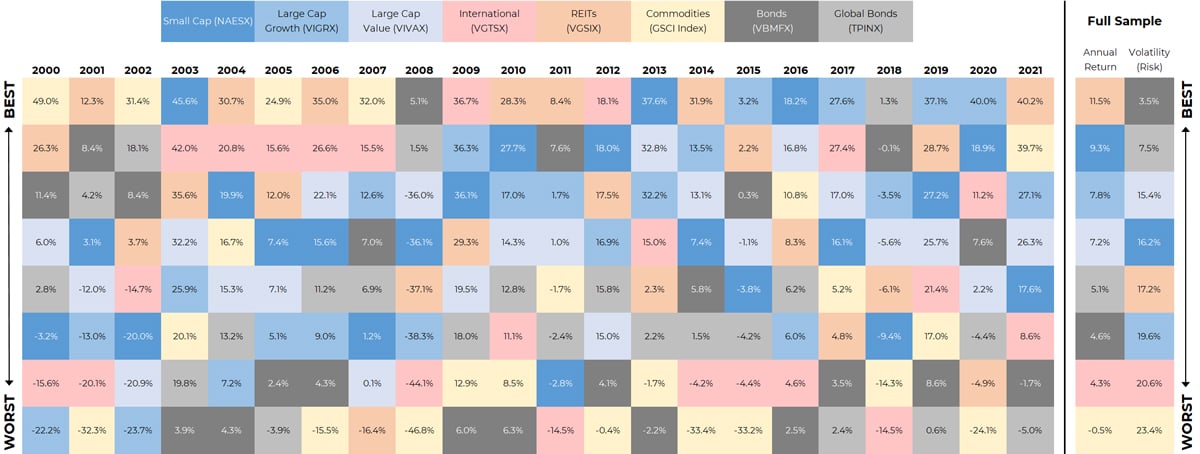

Many financial advisors are familiar with the “periodic table” of asset class performance like the image below, which is a popular tool for illustrating the importance of diversification to clients.

Borrowing from chemistry, it shows calendar years from left to right, with individual asset classes lined up under each year in descending order of their performance. The main point is to show that any asset class can vary widely from one year to the next, going from a top performer to one of the worst. Thus, portfolio diversification it is best.

Global Asset Class Annual Returns (2000-2021)

click to enlarge

click to enlarge

Source: ICE Data Services, 1/1/2000 to 1/31/2021

To help financial advisors visualize the impact of asset class and time diversification, Blueprint Investment Partners has taken the “periodic table” takes the concept a step further by adding:

- A buy-and-hold diversified portfolio to show the impact of asset class diversification

- A trend-followed diversified portfolio to illustrate the effect of asset class diversification and time diversification

Let’s talk if you’d like to discuss further.

Blueprint Investment Partners is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. For more information please visit adviserinfo.sec.gov and search for our firm name.

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation.

Information obtained from third-party sources is believed to be reliable though its accuracy is not guaranteed.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from Blueprint.

An index is an unmanaged portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.